ATC Brokers Review

Brokerage company ATC Brokers started its activities in 2005 in the USA and was among the first to offer its customers simultaneous trading in currency instruments and futures.

Head Office Address Glendale Plaza 655 N. Central Ave, Ste 1450 Glendale, CA 91203 USA. In order to expand its client base, a subsidiary of an American broker, known as ATC BROKERS LTD, was registered in the UK. Its main function is to provide brokerage services to clients residing in the European continent.

Regulated: CFTC / NFA (0358522), FCA (United Kingdom), 591361. For more details see the “Regulation” page at http://atcbrokers.com/company/#regulation.

Trading conditions:

- Min. deposit: $3000.

- Leverage: 1:200.

- Min. transaction size: 0.1 lot.

- Demo: Yes.

- Min. spread: 0.6.

- Commission: 0.

- Payment methods – bank transfer, payment cards (Maximum withdrawal amount $10,000 per calendar month), Automated Clearing House (ACH).

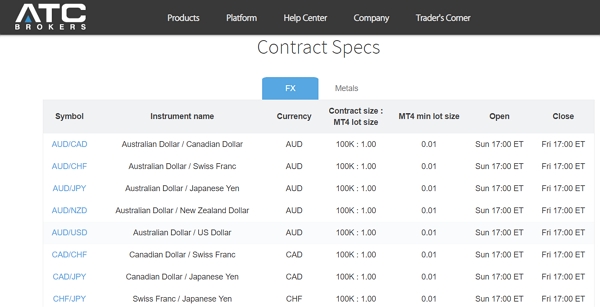

- Trading assets: 100.

- Scalping: allowed.

At the beginning of 2018, ATC Brokers launched the PAMM Plus service. According to the developers, the powerful ECN engine is implemented in the PAMM Plus algorithm, which allows users to use unique features:

- Regulate investment participation levels.

- Establish the maximum allowable level of capital loss.

- Make a cash investment or close an investment account during market hours.

- Enjoy all the benefits of an ECN account.

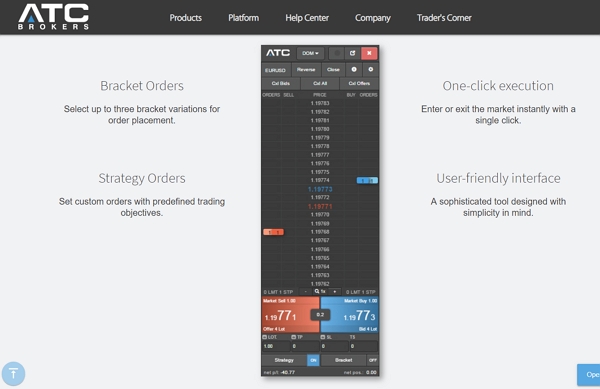

Trading Platform:

For transactions in the financial market, ATC Brokers customers use the MetaTrader 4 PRO terminal. This is a modified version of the classic MT4, the developers of the broker. It has more advanced functionality, fixed some bugs that are found in MT4, and added interesting “chips”.

- Advanced reporting unit.

- Information on the number of profitable or unprofitable transactions closed by the user.

- Information on historical trade indicators.

Platform is available in 2 versions:

- for computers and laptops.

- Mobile trading: iOS, Android.

MT4 Pro software retrieves trading data from your account and provides various types of reports. The list below is an example of what can be viewed from the collected data.

The company allows its clients to use advisors, does not impose trading strategies, allowing them to hedge positions, and also practice scalping.

Analytics and training:

There is no section on market analytics, news review and forecasting of price movements. Therefore, traders have to focus on their own experience, technical tools embedded in the terminal, or third-party resources during the analysis of the market situation.

There is no educational block either. No theoretical materials (articles, e-books, video tutorials, etc.). Special seminars, webinars and courses are also not available. The company is only interested in experienced traders.

Support:

For communication with company representatives, you can use several options:

- special online form;

- telephone hotline (1.877.654.8400);

- email [email protected];

- online chat (on site);

Communication and correspondence is conducted only in English.