Haitong International Review

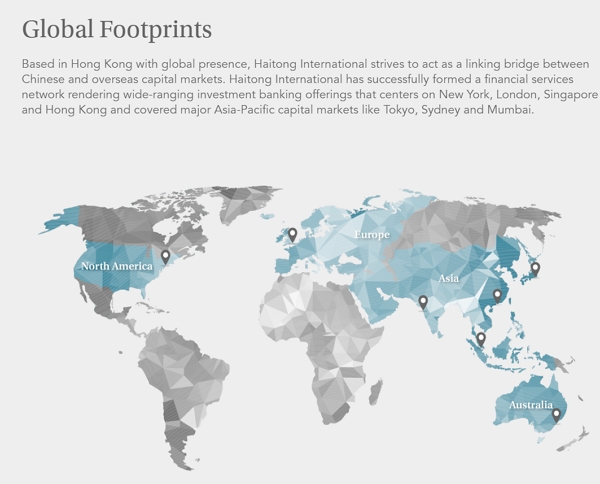

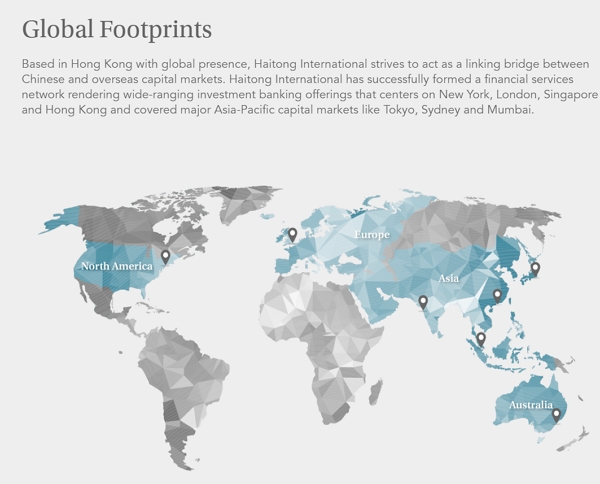

Haitong International Securities Group Limited (“Haitong International”; Stock Code: 665.HK) is an international financial institution with a permanent presence in Hong Kong and a rapidly growing network around the world. The company aims to serve as a bridge connecting Chinese and foreign capital markets. The parent company of Haitong International is Haitong Securities Co. Ltd (Haitong Securities, Stock Code: 600837.SH; 6837.HK).

Haitong International is set to continue growing and after launching its warrants business last year, it is already ranked within the top 10 issuers in Hong Kong by volume (according to bloomberg)

Haitong is licensed by the Monetary Authority of Singapore (MAS).

All forex brokers must be licensed by MAS to work legally in Singapore. The watchdog committee has the full right to issue and revoke licenses. Forex brokers are constantly monitored and are required to regularly provide audit reports to the MAS.

Trading conditions:

Min deposit: Allows traders to trade without depositing a company account;

Deposit currency: SGD, HKD, USD;

Leverage up to 1:20;

Website languages: Chinese, English;

Scalping: yes;

Hedging: yes;

Automatic trading: yes;

Trade 24 hours a day;

The broker does not provide a demo account, but allows the demonstration of the trading system in real time;

Cryptocurrency trading;

Trading platform

The company promotes mobile trading. The latest official version of the mobile platform is the Haitong International App, from the Haitong International Securities Group Limited. The Haitong International App offers real-time market news, real-time market data in Hong Kong and the A-Share market, trading functions including securities, warrants, CBBC and online IPO subscriptions.

Web Securities Trading works with Internet Explorer, providing access to the following functions:

– Online HK, B share, US Stocks Trading;

– Consolidated buying power;

– Multi-currency trading support;

– IPO;

– Real time order status tracking and 24 hour account enquiry

– and many others;

Also, all clients have the opportunity to trade using the popular MetaTrader 4 platform.

Account types

Account fees and inactivity fees HK$10 per month

- Individual account

For new customers, you must register the specified bank account (bank account in Hong Kong or abroad) to withdraw funds when opening an account. Clients must provide copies of bank statements or bankbooks (the document must be completely filled out, on which the name of the Client, the name of the bank and the bank account number must be clearly indicated) for verification purposes. - Corporate account

Registration requires certain documents. The list can be found by clicking on this link - Margin securities account

Investors must deposit a certain amount of funds in their margin account in advance, after which they can purchase shares in excess of the principal fund available in their account. Haitong will finance the difference in the amount. Securities will be held at Haitong International as collateral. Since the price of securities may fluctuate, the broker reserves the right to ask clients to deposit additional funds if the margin position of the client has fallen below the service level.

Training and Analytics

The training material includes video tutorials and a section on frequently asked questions.