Saxo Bank Review

Saxo Bank is a Danish investment bank, that specializes on online-investitions on international markets, and gives to its clients an opportunity to trade with a wide range of financial instruments. Also it provides services of fiduciary management.

Regulation

It is regulated by more than 10 regulators from all around the world, including the high level regulators.

Who can open an account?

An account can be created by any person, except of the residents of:

- the USA;

- Iran;

- Cuba;

- Sudan;

- North Korea;

- Syria

Also, there are some limitations for the residents of Canada. According to the local law, dwellers of Ontario, Newfoundland and Labrador can’t open an account.

The process of account opening

In order to do that, you will need to pass through 3 steps:

- Online application.

- Approval process.

- Replenishment

Online application tooks no more than 15 minutes. It requires such documents:

- ID;

- Confirmation of the residential address.

The process of approval usually lasts about 2 days. Replenishment can take from 2 to 5 days, depending on the payment method.

A range of instruments

Saxo Bank gives an opportunity to trade with:

- more than 100 currency pairs;

- cryptocurrencies (Bitcoin);

- shares and ETFs on 30 markets;

- more than 5000 bonds from 40 countries;

- options on shares, market indices, forex and commodities;

- futures on commodities, stocks, indices, bonds and currencies on 22 global markets;

- CFDs and certificates on 29 market indices and 8840 stocks;

Types of accounts

There are 4 of them:

- Classic — min deposit is 2000$;

- Premiun — 100 000 $;

- Platinum — 500 000 $;

- VIP — 1 000 000 $.

Also, there is a demo account.

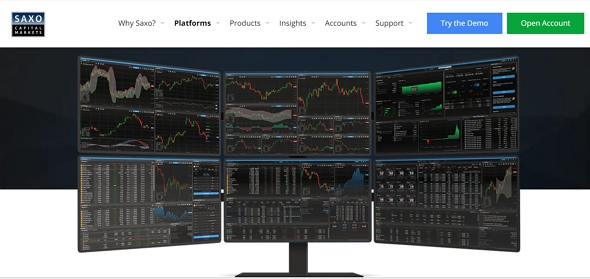

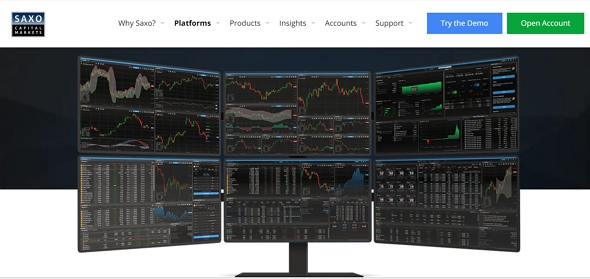

Platforms

This company gives an opportunity to trade using an own platform called SaxoTrader. It has a lot of tools, but thanks to a user friendly menu you can easily find whatever you need. There are all the necessary features:

- watchlist;

- interactive graphic;

- the main instruments for fundamental analysis;

- trade signals;

- news;

- the list ant tools of preventions;

- models of portfolios for copying;

- the review of positions, orders, and portfolio.

Advantages

The pluses are:

- Well-thought-out and user friendly platform.

- A very wide range of financial instruments.

- A good research activity.

- Regulation by more than 10 regulators from all around the world.

Disadvantages

There are some significant minuses:

- A high min deposit.

- Not very favourable fee policy.