TradeStation Review

Trade Station is a reliable American brokerage company. It is regulated by American legislation. The head office is quotated on Tokyo stock market, but doesn’t have any bank support.

This brokerage company meets the requirements of SEC and comes under the American scheme of investors protection SIPC. It protects the clients’ actives in the bigger amount, than European schemes. The limit of protection amount is 500 thousand dollars, including 250 thousand dollars in cash.

Opening an account

The process of opening an account is slow for those, who doesn’t live in the USA. The account can be created by a resident of any country, except of North Korea and Sudan.

Types of accounts

There are a lot of them, but the main are:

- Cash account.

- Marginal account.

- Account for futures.

They differ in the minimal deposit and the list of available trading instruments.

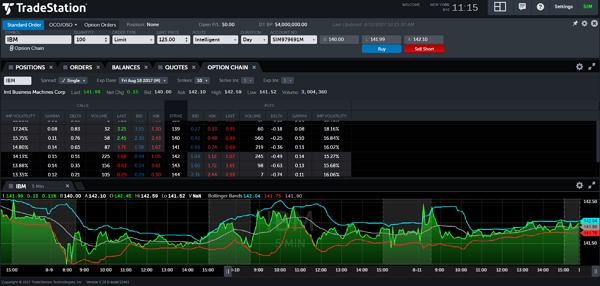

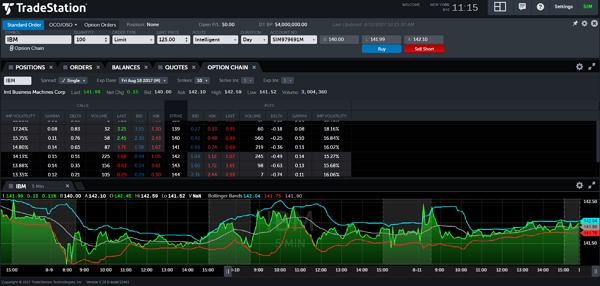

Available products

Trade Station gives you an opportunity to operate with such financial instruments:

- stocks (on 6 markets: NYSE, NYSE-ARCA, AMEX, NASDAQ, BATS, OTC);

- ETF (on 6 markets: AMEX, NYSE, NYSE-ARCA, BATS, NASDAQ, OTC);

- options (on 4 markets: OPRA, NYSE, NYSE-AMEX, NYSE);

- futures (on 7 markets: CME, CBOT, CFE, EUREX, NYMEX, ICE, LIFFE);

- fonds (80 variants);

But all of them are traded only on the US markets.

Commissions

All in all, the commission politic in Trade Station is competitve, but some non-trade fees can be rather high. There are 3 tariff plans:

- For a deal (All of them have a fixed price for a deal: 5$ for 1 stock or ETF, 14,95$ for a fond, 0,5$ for an option, 1,2$ for a future, 19,95$ for a bond. If your balance is less than 2000$ or you execute less than 5 orders a year, there is a fee of 50$ a year for inactivity).

- For a stock (A fixed fee in an amount of 0,01$ for 1 stock, but not less, than 1$. You should have a balance of 100 000$ or more, or execute orders with 5000 stocks or 50 options a month. Otherwise, there is a commission of 100$ for inactivity).

- Unrelated (Fee is the same as in «for a stock», but if you made deals with more than 100 000 stocks in a month, the commission will decline).

Advantages

The pluses are:

- A high amount of funds protection.

- Competitive fees.

- Convenient mobile application.

- A wide range of tools, a lot of different types of orders, and useful additional features, such as push-notifications.

Disadvantages

The minuses are:

- The process of openning an account takes a long time.

- Only American markets are available.

- The support is slow.

- There is no demo account.