Home / Forex news / AUD/CAD Back at 0.9093

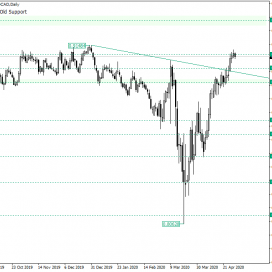

The Australian dollar versus the Canadian dollar currency pair is testing the important area of 0.9093. Where could the market go to?

Long-term perspective

The firm retracement that etched the low of 0.8062 caused a series of upward pointing legs, each of them confirming significant levels.

The last of them, 0.8472, facilitated a rally that managed to pierce not only the level of 0.8924 but also the double resistance drawn by the level of 0.9010 and the trendline that starts from the 0.9148 high.

Of course, after such a victory, the bulls need to catch their breaths and plan for what’s next.

However, as long as they can keep the price above the 0.9010 level, they can aim for their principal target, 0.9300.

This can happen either by a consolidation phase that takes the shape of a flag or pennant, either by a throwback that searches for a support level to start a new rise from. One such level could be 0.9010, but 0.8924 also may play good in this role, with the condition of a quick retracement above 0.9010.

Only if the bulls fail and, thus, the price falls under and confirms as resistance the 0.8924 level, then the bears would be entitled to believe that is their turn and, as a consequence, send the market to 0.8624.

Short-term perspective

The price is now oscillating within a range limited by the resistance of 0.9105 and the support of 0.9041, respectively. Around the middle of this flat sits an intermediary level, 0.9075.

If the bulls manage to tighten the flat, that is to change the support from 0.9041 to 0.9075, then, later on, they could pierce the resistance and confirm it as support. So, if 0.9150 changes to support, then the bulls could target 0.9153.

On the other hand, if 0.9075 remains only an intermediary level in the middle of the range that contains it, then the bears could push the price towards 0.9041, from where the bulls could push back.

Only if 0.9041 gets pierced and confirmed as resistance, then 0.8985 becomes exposed.

Levels to keep an eye on:

D1: 0.9010 0.9300 0.8924 0.8624

H4: 0.9075 0.9150 0.9153 0.9041 0.8985

If you have any questions, comments, or opinions regarding the Technical Analysis, feel free to post them using the commentary form below.

Original from: www.earnforex.com

No Comments on “AUD/CAD Back at 0.9093”