Home / Forex news / AUD/NZD Approaching the Monthly Support of 1.0530

The Australian dollar versus the New Zealand dollar currency pair is still falling, but it also approaches a very important support area. What will happen?

Long-term perspective

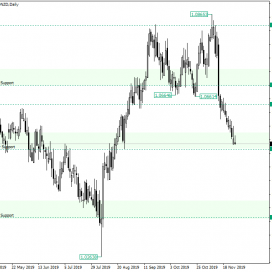

The appreciation that started at the weekly support of 1.0361 after the false piercing that printed the low of 1.0263 ended with a consolidation that failed to continue.

The consolidation, which took the shape of a flat limited by the support of 1.0689 and the resistance of 1.0837, allowed a very powerful descend. The plummet took out the previous lows — 1.0664 and 1.0661, respectively — and pierced the next support, 1.0640.

The following movement lost part of its steam but continued descending in a very steady manner, thus reaching the 1.0530 area.

Given this behavior, it would be natural to expect that the fall will eventually halt. If the fact that the area where the bears decided to hit the breaks is packed with bulls is also took into account, then the expectation of an appreciation has ground.

So, if the support of 1.0530 is falsely pierced or confirmed, via a bullish pattern, then 1.0640 would be a first target, followed by 1.0689. With respect to this, November 26, is an inverted hammer. This pattern, if confirmed, just might be the catalyst for the appreciation. Such a confirmation would require one of the next three candles to close at least above the halfway mark of the entire length of the inverted hammer.

On the other hand, if somehow the bears manage to continue their pursuit, then 1.0361 is exposed.

Short-term perspective

After confirming the resistance of 1.0635, the price entered into a steady depreciation that reached the 1.0534 support.

The 1.0534 level is backed by the psychological level of 1.0500. As a consequence, if the first one gets pierced, the latter one might hold and facilitate a confirmation as support. If that happens, once the price is back above 1.0534, then an appreciation to 1.0635 is to be expected.

If 1.0500 fails, then 1.0440 is the next support area for the short-term.

Levels to keep an eye on:

D1: 1.0530 1.0640 1.0689 1.0361

H4: 1.0534 1.0500 1.0635 1.0440

If you have any questions, comments, or opinions regarding the Technical Analysis, feel free to post them using the commentary form below.

Original from: www.earnforex.com

No Comments on “AUD/NZD Approaching the Monthly Support of 1.0530”