Home / Forex news / AUD/NZD Toward the 1.0707 Area

The Australian versus the New Zealand dollar currency pair seems to be determined to reach 1.0707. Are the bulls really up to the job?

Long-term perspective

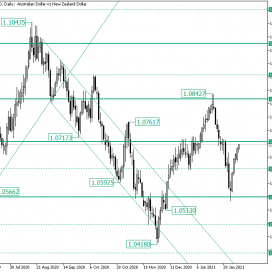

After printing the 1.0566 low, the price accelerated to the 1.1042 high. As they failed to secure the 1.0983 area as support, the bulls could only witness their efforts being washed away as the bears set in motion a falling trend.

However, the descending trend came to a halt at the 1.0418 low. As the low marks the head of an inverted head and shoulders, the bulls had the argument they needed to craft a new rise.

This brought the price to the 1.0842 high, a little above the level of 1.0826. As history repeats itself, the bears spoiled the bullish plans once more, as they put the price beneath 1.0842 before sending it into a stall that passed 1.0707 with relative ease and stopped at the next support area, 1.0551, respectively.

From 1.0551, the bulls rotated the price, heading it to 1.0707 in a movement with such surpassing momentum that, contrary to the price action at the end of December 2020, it did not need to validate the 1.0630 intermediary level as support to conserve itself.

If the bulls keep up this pace, 1.0707 being validated as support is just a matter of time. Still, if 1.0707 absorbs the bullish pressure, the 1.0631 intermediary level is there to aid a new rally after it plays the role of the first bearish objective.

Of course, with 1.0707 cleared, the bulls may aim for 1.0826.

Short-term perspective

The consolidation that unfolded just above the 1.0681 intermediary level etched a rise that climbed until the 1.0842 high. From the 1.0839 high, the fall that would reach the 1.0540 commenced.

On their path to the 1.0540 low, the bears took their breath over the 1.0681 intermediary level, an area that served the formation of the 1.0709 high, it, in turn, acting as the second point on which the falling trendline to rest on.

As the trendline — actually, the double resistance that it defines alongside the 1.0621 intermediary level — was pierced, the bulls pushed the price toward the next resistance area, 1.0681.

If the bulls do manage to acquire 1.0681, then 1.0741 is their next target. On the flip side, if the bears are the ones that win, then 1.0621 may receive a new visit.

Levels to keep an eye on:

D1: 1.0707 1.0631 1.0826

H4: 1.0681 1.0741 1.0621

If you have any questions, comments, or opinions regarding the Technical Analysis, feel free to post them using the commentary form below.

Original from: www.earnforex.com

No Comments on “AUD/NZD Toward the 1.0707 Area”