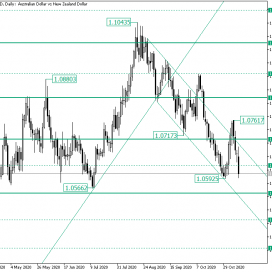

Home / Forex news / AUD/NZD Under 1.0707 and Back into the Descending Channel

The Australian pound versus the New Zealand dollar currency pair seems to have been limited in its attempt to switch to bullish mode.

Long-term perspective

After crafting the 1.0566 low, the price continued its upward movement that had been part of before the high of 1.0880.

As a result, it climbed until the 1.1043 high but failed to sustain the gains above the firm resistance area of 1.0983.

As a consequence, the price fell until the previous resistance area, 1.0826, breaking the intermediary level of 1.0895 in the process.

Still, the bulls attempted to regain momentum, defining a new rally from the double support area noted by 1.0826 and the ascending trendline.

Yet again, they only managed to draw a new false piercing, this time of the 1.0895 level.

Following this, the bears pushed the price under the 1.0826 level, driving it until the 1.0717 low.

The bulls refreshed their effort to retake hold of the situation, but, this time, they validated 1.0895 as resistance, thus failing even to obtain a false piercing.

So, the bears were, once again, ready for a new depreciation, this time sending the price to the 1.0592 low and securing a descending trend in the process.

The high of 1.0761 is a reaffirmation of the bearish trend, the price slipping under the upper line of the descending channel prolonging the bearish dominance.

If from 1.0631, the bulls can mark a rally that conquers 1.0707, then they can hope for 1.0826. However, as long as the price is contained within the descending channel and under the 1.0707 level, 1.0551 is the next bearish objective.

Short-term perspective

From the 1.0893 high, the price started a sustained decline, one that reached the 1.0593 low.

From there, the bulls rotated the price, sending it beyond 1.0741. Still, that was not enough, as the price got under the level and oscillating in such a manner that it checked a head and shoulders pattern with 1.0681 as the neckline and slipped beneath 1.0621.

So, if the price remains under 1.0621, then the next stop is 1.0573. On the flip side, 1.0621 being conquered opens the door to 1.0741 and then to 1.0778.

Levels to keep an eye on:

D1: 1.0631 1.0707 1.0826 1.0551

H4: 1.0681 1.0621 1.0573 1.0741 1.0778

If you have any questions, comments, or opinions regarding the Technical Analysis, feel free to post them using the commentary form below.

Original from: www.earnforex.com

No Comments on “AUD/NZD Under 1.0707 and Back into the Descending Channel”