Home / Forex news / AUD/NZD Was Failed by the Weekly 1.0361 Support

The Australian dollar versus the New Zealand dollar currency pair passed under an important support. Is this break destined to be a false one?

Long-term perspective

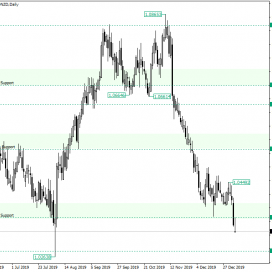

The depreciation that started after the false break of 1.0837 breached important support areas along its way. The first one was the 1.0689 weekly and the second one the 1.0530 monthly.

The downwards movement stopped just above the 1.0361 area in the form of a consolidation pattern. During this phase, the candle on December 18 made a sharp retracement from the supportive area, a reaction that made the bulls put their hope in the supportive role of 1.0361.

Even if the price tried to bottom at the supportive 1.0361 area, eventually the level did not sustain the bullish attempts, resulting in a breach. Even more, the candle on January 7, closed under this area, and the one that follows it oscillated under it, thus further enriching the bearish potential.

In this context, two scenarios are possible. The first one is for the price to continue descending. In this case, 1.0277 serves as a first target.

The second scenario is the one in which the current piercing ends up as a false one. This will happen if the price manages to get back above the 1.0361 area. If this happens, a conservative trader will wait for the high of 1.0449 to be taken out. Only then they will be aiming for 1.0530.

Short-term perspective

The price oscillated in a consolidation phase that had its support at 1.0404. That support was eventually pierced. This allowed a relative strong depreciation to begin, one that was able to pass the next support, 1.0368, respectively.

This unfolding led to a strong bearish pressure, one that will offer enough determination to reach the 1.0282 level.

Only if the price keeps oscillating above or falsely pierces the 1.0332 level, then the price may head for 1.0368. From there, the bears might join the market at better prices, a behavior that will bring the price back to 1.0282. On the other hand, if 1.0368 gets confirmed as support, then 1.0440 represents a first target.

Levels to keep an eye on:

D1: 1.0277 1.0361 1.0530

H4: 1.0282 1.0332 1.0368 1.0440

If you have any questions, comments, or opinions regarding the Technical Analysis, feel free to post them using the commentary form below.

Original from: www.earnforex.com

No Comments on “AUD/NZD Was Failed by the Weekly 1.0361 Support”