Home / Forex news / AUD/USD Challenged by the 0.7320 Resistance Area

The Australian versus the US dollar currency pair wants to continue the appreciation, but it seems to be limited by the 0.7320 resistance. Is this the end of the road for the bulls?

Long-term perspective

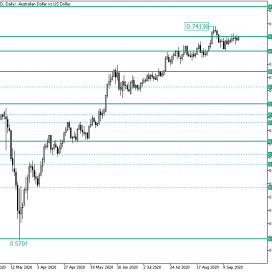

The rally that came about after the strong retracement from the 0.5701 low, which validated the 0.5516 support, started an ascending movement that extended until the .07413 high.

The high is part of what appears to be a false piercing of the 0.7320 firm level. However, as the resulting fall found support at 0.7191, the bulls made another attempt to secure 0.7320.

Nevertheless, the bears seem to be very reluctant giving away any more pips above 0.7320. The interesting part is that, as the 0.7320 resistance seems to remain in place, the price is not starting a convincing depreciation, as it would be expected after it encounters a resistance area.

As a result, the zone enclosed between 0.7320 and 0.7191 may be considered as a neutral one — which a slight chance of favoring the bulls, the reason behind this being that the overall trend is a bullish one.

So, if the bulls do manage to validate 0.7320 as support, then they have 0.7587 as the main target. Of course, along the way, the psychological 0.7400 and 0.7500 levels, respectively (which are not highlighted on the chart), are intermediary profit booking areas.

On the flip side, if 0.7191 becomes resistance, then 0.7010 gets exposed.

Short-term perspective

The appreciation from the 0.7135 low extended until the 0.7413 high. From there, after confirming the firm 0.7390 resistance, the price started a depreciation that pushed beyond 0.7236, printing the 0.7192 low, only to retrace above the level later on.

After this false piercing of 0.7236, the price met the 0.7341 intermediary resistance level, etching the 0.7345 high. Since then, the price is contained within a flat in which 0.7341 acts as resistance and 0.7236 as overall support.

As the 0.7245 low is a higher low with respect to 0.7192, and as also higher highs can be spotted, the resulting ascending trend is expected to aid the bullish endeavor and, as a result, facilitate 0.7341 in becoming support. If this happens, then the next bullish target is at 0.7398.

However, if 0.7236 gets revisited, then the bears may come into play, extending the decline until 0.7170.

Levels to keep an eye on:

D1: 0.7320 0.7191 0.7587 0.7010

H4: 0.7341 0.7236 0.7341 0.7398 0.7170

If you have any questions, comments, or opinions regarding the US Dollar, feel free to post them using the commentary form below.

Original from: www.earnforex.com

No Comments on “AUD/USD Challenged by the 0.7320 Resistance Area”