Home / Forex news / AUD/USD Hanging on the 0.6850 Level

The Australian dollar versus the US dollar currency pair reached an important resistance area. Both the bulls and bears could use this it for good alignment in the market, but the question is which of them will take control?

Long-term perspective

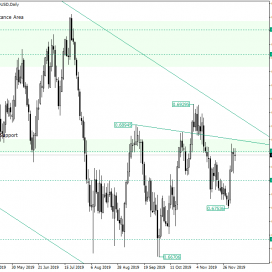

After bottoming at the 0.6700 psychological level and printing the last low at 0.6670, the price appreciated and pierced the major support of 0.6850.

The rally continued until the peak of 0.6929, from where a depreciation commenced, one that took the price under 0.6850 and extended to the low of 0.6753.

From the 0.6753 low, a new rally took place. This time the price took a pause just under 0.6850 which, alongside the trendline that joins the high of 0.6894 with the next relevant high, forms a double resistance.

To note is that the day of December 5 looks like a hanging man. Because it is printed at an important resistance area, the bears have reasons to hope for a downwards pointing leg.

However, the hanging man is not actually a hanging man, the amendment being that the upper shadow is too long — it should not be longer than the body.

Another aspect is that the market printed higher lows and higher highs, respectively, which are labeled on the chart. Considering this, the appreciation that starts from 0.6753, can be seen as an impulsive swing that should last at least until the resistance trendline of the channel that contains the entire descending trend.

So, after the price pierces 0.6850 and turns it into support, an appreciation that targets the psychological level of 0.6900 — not visible on the chart — is in the cards.

If the price reaches the 0.6800 support, then the situation turns neutral.

Short-term perspective

After appreciating from the 23.6 Fibonacci retracement projection, the price conquered 38.2. As it managed this, it began a consolidation phase limited by the resistance of 0.6855.

As long as 38.2 holds, further appreciation is to be expected. After the price confirms 0.6855 as support, then 50.0 will be the next target. If 50.0 is also conquered, then 61.8 is the next target.

Only if 38.2 is turned into resistance, then the aim would be 23.6.

Levels to keep an eye on:

D1: 0.6850 0.6800

H4: 0.6855 and the Fibonacci retracement projections of 38.2 50.0 61.8 23.6

If you have any questions, comments, or opinions regarding the US Dollar, feel free to post them using the commentary form below.

Original from: www.earnforex.com

No Comments on “AUD/USD Hanging on the 0.6850 Level”