Home / Forex news / AUD/USD Plunged to 0.63 and Recovered. What Now?

The Australian dollar versus the US dollar currency pair depreciated strongly. Will the recovery last?

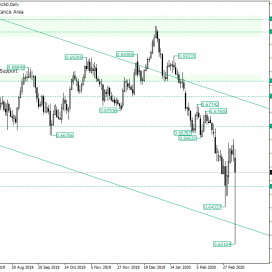

Long-term perspective

After confirming the double resistance area marked by the levels of 0.7055 and 0.7013, respectively, the price formed a head and shoulders pattern that favored a return inside the descending channel.

Once back in the channel, the bears pushed the price lower and lower, disengaging the supportive role of 0.6700 and piecing the 0.6500 psychological level. But the 0.6500 was backed by some very determined bulls that caused a strong retracement.

However, the beginning of the week brought about a sharp decline. In fact, the depreciation was so pronounced that it went past the previous low of 0.6433, pierced the next psychological level (0.6400, which is not highlighted on the chart), punctured the lower line of the descending channel, and returned only after etching the low of 0.6310.

The retracement from 0.6310, on the other hand, sent the price back into the channel and back above 0.6500.

Considering the strong retracement, the market may be giving its sign of willingness to start a movement towards the north.

So, as long as the price oscillates above 0.6500, the main target is represented by 0.6700. But given the high volatility, it is possible to see the price going back beneath 0.6500. If these events do not end up as false piercings of 0.6500 (which would lead to the previously discussed development) and the price actually succeeds in stabilizing under 0.6500, then one of the next two possible scenarios can take place.

The first one still favors the bulls. In other words, the depreciation that may start after 0.6500 is confirmed as resistance might stop around — preferably at or above — the low of 0.6433, as the bulls are seeking better prices to long the market. This can allow the price to come back above 0.6500.

In the second scenario, a relatively calm — less volatile — but firm descending wave can emerge. In this case, the profile shifts to bearish and the low of 0.6310 can become the next target.

Short-term perspective

The price strongly retraced from the low of 0.6310, getting above 0.6497, while still being under 0.6556.

As long as 0.6497 holds as support, further advancement is possible, putting 0.6310 at risk for being pierced and confirmed as support. If this happens, then 0.6500 is the next target.

However, if 0.6497 is breached, then the same 0.6433 and 0.6310 lows are the main bearish targets.

Levels to keep an eye on:

D1: 0.6500 0.6700 and the lows of 0.6433 0.6310

H4: 0.6497 0.6310 0.6500

If you have any questions, comments, or opinions regarding the US Dollar, feel free to post them using the commentary form below.

Original from: www.earnforex.com

No Comments on “AUD/USD Plunged to 0.63 and Recovered. What Now?”