Home / Forex news / AUD/USD Value Emerging, but Coronavirus Fears Dominate for Now

Risk appetite has gone from bad to worse today, with major indices trading lower by roughly -3% across the board and US 10-year yields hitting all-time record low levels intraday.

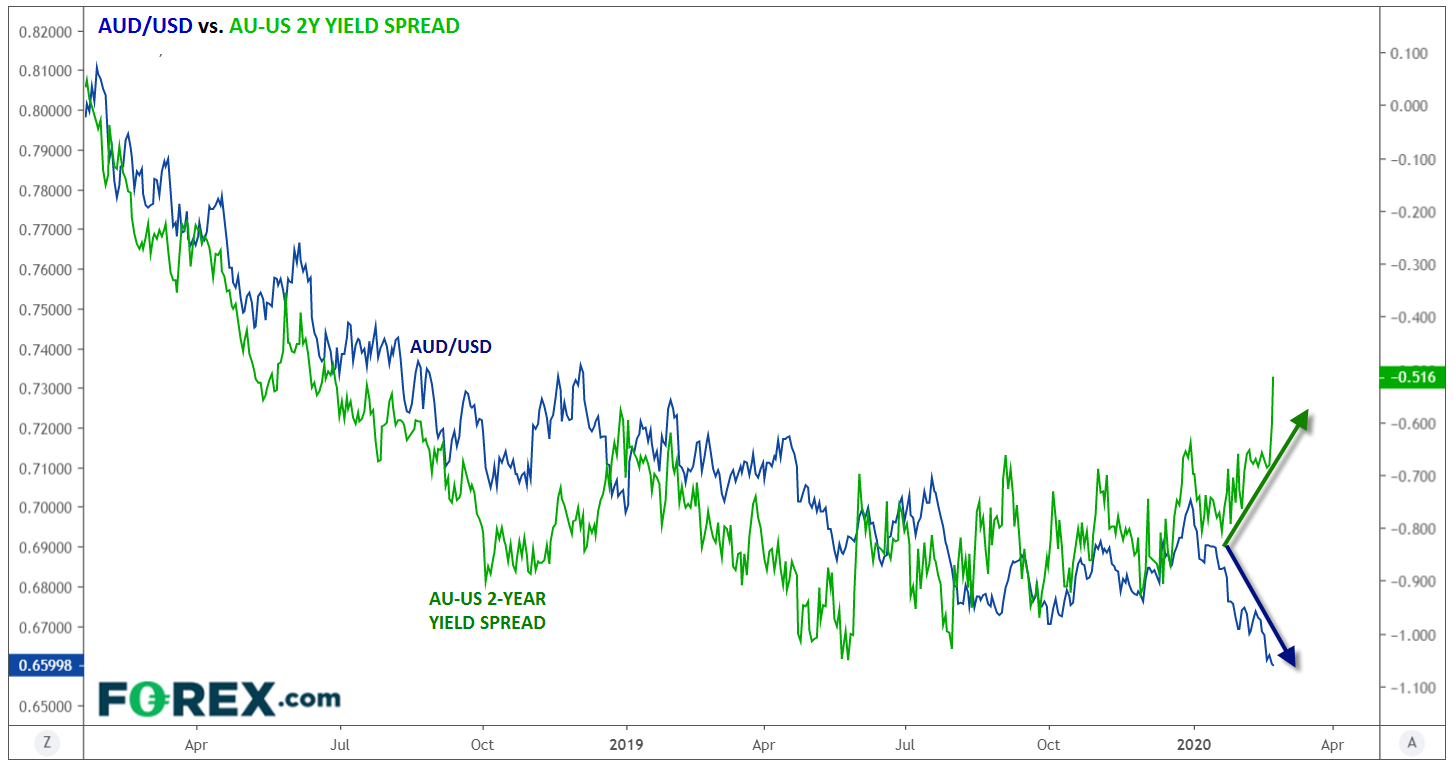

When it comes to the FX market, one interesting dynamic at play in the current environment is the balance between relative yield spreads and risk appetite. As traders simultaneously sell risk assets, including higher-yielding G10 currencies like the Australian dollar, and buy perceived “safe haven” assets like US bonds, pairs like AUD/USD look increasingly appealing (maybe “decreasingly unappealing” would be more apt) from a relative value perspective.

Looking at the chart of the AUD/USD pair against the spread between Australian and US 2-year bond yields, we can see a clear divergence has taken hold since mid-January, with Australian yields holding up relatively well while the aussie continues to hit new lows against the greenback:

Source: TradingView, GAIN Capital

Speaking bluntly, with traders far more concerned with the return of their capital than the return on their capital in the current environment, this divergence is not surprising. However, when the market starts to conclude that the spread of coronavirus is back “under control” (whenever that may be), FX traders will quickly look to scoop up currencies fell too far, too fast during this risk-off phase. Based on the improving short-term yield spread, AUD/USD is a strong candidate for a sharp recovery when that happens.

Original from: www.forex.com

No Comments on “AUD/USD Value Emerging, but Coronavirus Fears Dominate for Now”