Home / Forex news / Australian Dollar Attempts to Rebound After Flash Crash

The Australian dollar rose today, attempting to rebound after the recent flash crash. But today’s gains were nowhere near enough to erase losses the currency has logged since the end of the last week. The coronavirus continues to spread across the globe, hurting demand for riskier currencies linked to commodities. Negative domestic macroeconomic data was not helping the matter either.

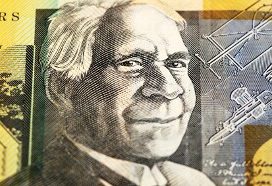

Guy Debelle, Deputy Governor of the Reserve Bank of Australia, talked about the impact of the virus on the economy in a speech today. He said that, while developments in the global economy had looked positive ahead of the outbreak, the spread of the COVID-19 disease has changed that:

There is no doubt that the outbreak of the virus has significantly disrupted this momentum, initially in China and now more broadly. We do not have a clear picture yet on the disruption to the Chinese economy caused by the virus and the measures put in place to contain the virus. But the following two graphs provide some sense of the significant disruption to the Chinese people and economy.

The rest of the world also felt the impact of the virus, though currently, it is too early to say how big the damage will be:

In the meantime, the virus has spread to other countries. They too are beginning to suffer significant disruptions, the extent and duration of which is unknown at this time.

The Governor also talked about the negative impact the outbreak had on the Australian economy, though he was optimistic about the economy once the outbreak ends:

The effect of the virus will come to an end at some point. Once we get beyond the effect of the virus, the Australian economy will be supported by the low level of interest rates, the lower exchange rate, a pick-up in mining investment, sustained spending on infrastructure and an expected recovery in residential construction.

As for macroeconomic data, the Westpac-Melbourne Institute Index of Consumer Sentiment fell 3.8% in March, hitting the lowest level in five years and the second-lowest since the global financial crisis. Unsurprisingly, the coronavirus was the main reason for the drop as the report said:

The worsening coronavirus outbreak and associated rout in financial markets have had a major impact on sentiment this month.

According to data National Australia Bank released yesterday, business conditions fell from +2 to 0 and business confidence dropped from -1 to -4 in February. Alan Oster, NAB Group Chief Economist, talked about the impact the coronavirus had on the confidence:

We will closely watch the business survey for any impacts of the Coronavirus. Our special question this month suggests around 50% of firms have been unaffected to date, and the bulk of those that have been report only a minor impact. However, it is very possible this number will rise as the spread of the virus continues â this would most likely result in a further deterioration in confidence and eventually reported business conditions.

AUD/USD rallied from 0.6489 to 0.6525 as of 9:45 GMT today. EUR/AUD traded at 1.7322 after opening at 1.7384 and rising to the daily high of 1.7480. AUD/JPY opened at 68.31, fell to the session minimum of 67.65 but bounced to 68.69 later.

If you have any questions, comments, or opinions regarding the Australian Dollar, feel free to post them using the commentary form below.

Original from: www.earnforex.com

No Comments on “Australian Dollar Attempts to Rebound After Flash Crash”