Home / Forex news / Bearish Resistance at 106.12 on USD/JPY?

The United States dollar versus the Japanese yen currency pair may have trouble passing the 106.12 level. Is this just a bullish pause?

Long-term perspective

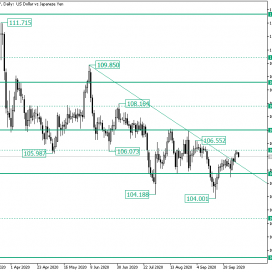

The drop from the 111.71 peak delivered two flats. The first one is limited by 109.00 as resistance — with the amendment of the 109.85 fake breakout — and 107.00 as support — joined by two false piercings that were bounded by the 106.12 intermediary level.

The second is confined within 107.00, which plays the role of resistance, and 105.03, a support area that also allowed two false piercings, etched at 104.18 and 104.00, respectively.

Speaking of false breakouts, it appears that 104.00 served as a launchpad that enabled the bulls to regain 105.09. Once above it, the bulls validated 105.09 as support and extended their movement, puncturing the descending trendline in the process.

If the bulls are able to keep up the current enthusiasm and validate the intermediary level of 106.12 as support, then 107.00 can be their next objective.

On the other hand, a miss in reconquering 106.12 could spell a retracement towards the double support area defined by the descending trendline and the 105.09 level.

Short-term perspective

From the 104.00 low, the price went above the firm level of 104.44, reinforced it as support, and continued towards the north, securing the 105.27 intermediary level.

After a failed bearish attempt, that left behind the 104.94 low as part of a false piercing of 105.27, the bulls continued their journey, reaching the 106.02 area.

If they can acquire 106.02, then 106.77 would be their next target. On the flip side, if the price falls from 106.02, then 105.27 may be paid a visit.

Levels to keep an eye on:

D1: 106.12 107.00 105.09

H4: 106.02 106.77 105.27

If you have any questions, comments, or opinions regarding the US Dollar, feel free to post them using the commentary form below.

Original from: www.earnforex.com

No Comments on “Bearish Resistance at 106.12 on USD/JPY?”