Home / Forex news / Bears Back on USD/JPY from 105.76 High?

The United States dollar versus the Japanese yen currency pair seems to be dominated by the bears. Are the bulls going to step in?

Long-term perspective

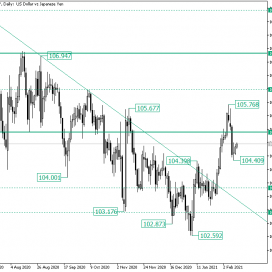

After validating the double resistance area defined by the falling trendline (that starts from the 108.16 high — not visible on the chart) and the firm resistance area of 107.00, the price continued the descending trend until the 102.59 low.

From the 102.59 low, a new correction started, similarly as the previous ones did from the 104.00 and 103.17 lows, respectively. In contrast to them, the bears were not able to craft a determined decline — like they were on the previous occasions, from the 106.94 or 105.67 highs.

Instead, a flag took shape, aiding the double resistance formed by the same falling trendline and — this time — the 103.78 intermediary level to start acting as support.

As a consequence, the area was pierced and the bulls were free to send the price above the next resistance area, 105.09, etching the 105.76 high.

From there, the bears came to their senses and did not allow the bulls to find support at the 105.09 level.

The result was the continuation of the fall from the 105.76 high, a fall that — as of writing — crafted the 104.40 low.

The first possible scenario is to see a short term continuation pattern taking shape — like a pennant or a flag. Another possible outcome is to see the price throwing back to the 105.09 area, with the purpose of confirming it as resistance. However, this scenario is not in the best interest of the bears, as the bulls may profit from the rise and send the price back above the 105.09 level, which in turn may lead to 106.12. Both scenarios target 103.74

Short-term perspective

The 103.55 low was the starting point of a rally that did not come to a stop before reaching the 105.76 high.

From there, the bulls attempted a consolidation phase just above the 105.27 intermediary level.

Failing to validate 105.27 as support, the bulls had little to do but let the bears play their part. Thus, the price dropped until the 104.44 area.

If 104.44 holds, then the consolidation phase may extend. However, the longer it extends, the greater chances that the bears will continue the fall, as the consolidation phase may end up as a range, which, usually, is aiding continuations.

So, 104.44 failing translates into the bears targeting the 103.71 level. On the flip side, if the bulls can thrust a rally from above 104.44, then 105.27 is their first objective.

Levels to keep an eye on:

D1: 105.09 106.12 103.74

H4: 104.44 103.71 105.27

If you have any questions, comments, or opinions regarding the US Dollar, feel free to post them using the commentary form below.

Original from: www.earnforex.com

No Comments on “Bears Back on USD/JPY from 105.76 High?”