Home / Forex news / Bears Letting Go to AUD/NZD After Fall from 1.0800?

The Australian versus the New Zealand dollar currency pair seems to be determined to disallow the bears to further go about their plans.

Long-term perspective

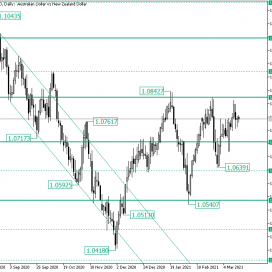

After the trend commencing at the 1.1043 high ended at the 1.0418 low, the bulls managed to print the 1.0842 high.

From there, the bears used the firm area of 1.0826 to reload their positions. This is precisely what they did, as the price ebbed until under the solid area of 1.0551 — at the 1.0540 low. Along this path, 1.0707 — a pivotal level as well — was swiftly taken out.

Still, as the bulls rotated the price from 1.0540, the price went above 1.0707 but stopped, yet again, at 1.0826. Following is another decline, one that set the price under 1.0707 as well. Anon, the bulls used the event in their favor, rotating the price and sending it above 1.0707.

Considering the higher lows — 1.0540 and 1.0639, respectively — and the fact that the 1.0707 level was falsely pierced on March the 9th, the bulls get the credit. In other words, as the bulls prove to be able to iron out every bearish attempt, one could expect that 1.0826 giving way is just a matter of time.

So, after 1.0826 becomes support, 1.0895 is the next bullish objective. On the other hand, if 1.0826 proves to be really strong resistance, then the bears may very well have 1.0707 on their map.

Short-term perspective

The fall from 1.0827 extended until 1.0639, from where the bulls sent the price back to the area of 1.0741.

After a consolidation around 1.0741, which was also accompanied by a validation of the 1.0681 level, the bulls pushed the price almost until the 1.0820 level.

From there, the bears pushed it back, casing a consolidation phase limited by 1.0778 as resistance and 1.0741 as support.

If the bulls can win 1.0778, then 1.0820 is their next target. On the flip side, if 1.0741 cedes, 1.0681 is to be paid a visit.

Levels to keep an eye on:

D1: 1.0826 1.0895 1.0707

H4: 1.0778 1.0820 1.0741 1.0681

If you have any questions, comments, or opinions regarding the Technical Analysis, feel free to post them using the commentary form below.

Original from: www.earnforex.com

No Comments on “Bears Letting Go to AUD/NZD After Fall from 1.0800?”