Home / Forex news / Bears Shorting USD/JPY from 109.08, Howeverâ¦

The US dollar versus the Japanese yen currency pair seems not to be so keen to start declining.

Long-term perspective

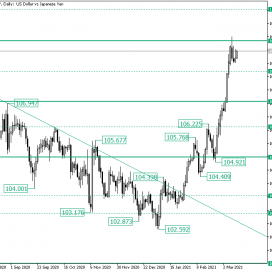

After validating the double resistance defined by the trendline and the firm area of 107.00, the falling trend continued, extending until the 102.59 low.

The low marked a turning point, as, from there, the bulls were able to put an end to the descending trend by a sharp rally that printed the 105.76 high.

The bears attempted to regain their supremacy, for they put the price under the 105.09 level. Yet again, the bulls rotated it, leaving behind the 104.40 higher low.

This aided the validation of 105.09 as support, which, in turn, catalyzed a surge that accomplished to meet the 109.03 primary zone. Even if March 8 and 9, respectively, form a dark cloud cover candlestick pattern, its effect — setting in motion a decline — failed to materialize.

This delay gives bulls the confidence they need, as the longer the decline is postponed, the greater the chances for a rally.

So, as long as the intermediary level of 108.05 allows the price to oscillate only above it, the bulls can target 109.08 with the purpose of piercing it — and turn it to support — so that they can go for 110.18.

Only if 108.05 cedes, the bears can hope for 107.00, for the correction may become a more pronounced one.

Short-term perspective

The validation of 104.44 allowed the bulls to note an ascension to the next equally important level of 106.02.

Still, on this first run, their endeavor ended with the false piercing of the level — as the 106.22 high points out.

After the resulting fall, the bulls responded in the same manner — by falsely piercing the 105.27 intermediary level.

As a consequence, a sustained appreciation commenced, one that pierced the firm area of 108.02 but stopped upon touching the next one, 109.27.

So, as either 108.53 or 108.02 is verified as support, 109.27 and 109.66 play the role of bullish targets.

A failure of 108.02 opens the door to 107.34 and, later on, to 106.77.

Levels to keep an eye on:

D1: 108.05 109.08 110.18 107.00

H4: 108.53 108.02 109.27 109.66 107.34 106.77

If you have any questions, comments, or opinions regarding the US Dollar, feel free to post them using the commentary form below.

Original from: www.earnforex.com

No Comments on “Bears Shorting USD/JPY from 109.08, However⦔