Home / Forex news / Bears Tried to Step In on AUD/NZD from 1.0773

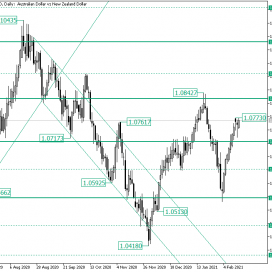

The Australian versus the New Zealand dollar currency pair seems to be under some bearish pressure. Is this the end of the rally that commenced from the firm area of 1.0551, or it’s just the bulls taking a well-deserved break?

Long-term perspective

The fall from the 1.1043 peak brought the price under the leading level of 1.0983, catalyzing the formation of a descending trend that led the price to the 1.0418 low.

From there, the bulls achieved printing an inverted head and shoulders chart pattern — which, in turn, sustained their efforts to win ground.

As a result, the bulls put an end to the falling trend, for they rose the price to the 1.0707 level.

Once there, the bears endeavored to resume the slide, but the bulls used the intermediary level of 1.0631 to their advantage, validating it as support to thrust through 1.0707.

This conducted in the price reaching the 1.0842 high. But as the price saluted the level, the bears, once more, intercepted the bulls — and, this time, they managed to cause a breakdown.

The fall extended until the 1.0551 level, from where the bulls defined a new rally. This brought the price — as of writing — to the 1.0773 high.

Believing that the price is just satisfying for them, the bears strived to cause another collapse. Nevertheless, the bulls rejected the trial, as the price stopped very close to the 1.0707 level.

From this point onward, a feasible scenario is the continuation of the rise, with 1.0826 on the bullish radar. The second scenario is for the price to retrace to the 1.0707 level. Once there, for as long as the price oscillates above 1.0707, a new movement toward the north is to be expected.

On the flip side, if 1.0707 cedes, then 1.0631 is to be paid a visit.

Short-term perspective

From the 1.0842 high, the price entered into a falling movement, one that noted the 1.0540 low.

The 1.0540 low facilitated a rise that pierced and departed from the trendline that starts from the 1.0839 high.

This is how the price got just under the 1.0778 intermediary level, unveiling a consolidative phase.

For a relatively short while, the price slipped under the 1.0741 intermediary support. As long as it lasts, the level may aid a new bullish price action unfolding. The first target is represented by the 1.0778 level, which, if conquered, opens the door to the second one — the firm 1.0820.

However, if 1.0741 is not able to keep the bears in check, then 1.0681 is the main bearish objective.

Levels to keep an eye on:

D1: 1.0707 1.0826 1.0631

H4: 1.0741 1.0778 1.0820 1.0681

If you have any questions, comments, or opinions regarding the Technical Analysis, feel free to post them using the commentary form below.

Original from: www.earnforex.com

No Comments on “Bears Tried to Step In on AUD/NZD from 1.0773”