Home / Forex news / Bears Trying to Start an Impulsive Swing from 0.6929

The Australian dollar versus the US dollar currency pair looks like it is failing in its appreciation efforts. Or isn’t it?

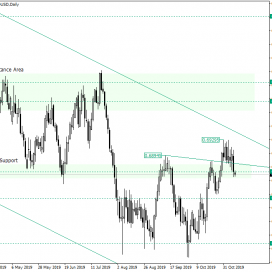

Long-term perspective

After bottoming around 0.6700 psychological level, the price began an appreciation that confirmed the 0.6800 area as support, pierced 0.6858, and peaked at 0.6929.

Afterward, the pair retraced at the 0.6858 level, raising the question of whether if the bulls are searching for better prices or if the bears are trying a comeback.

First of all, the main trend is still a downwards one, thus one crediting the bears can consider that he is making a simple and logical assumption.

However, even with the price inside a descending channel, the bears are far from being in control.

Fist of all, the bottoming at 0.6700 is a wasted chance for the bears, so it might take a while until they will be given a new opportunity. This is because of all the bullish optimism that was gathered as the price failed to make obtain a valid piercing of 0.6700.

Secondly, the 0.6929 peak din not retraced from an important area and in a fashion that would show bearish strength. In other words, the price did not touch the trendline and the possible impulse is not very convincing because of all the back and forth at the start of November.

So, any bullish price action pattern from the major support of 0.6850 has a great potential of starting a new movement towards the north, the first target being represented by 0.7013.

Only if 0.6850 is confirmed as resistance, then the 0.6800 psychological level can be revisited.

Short-term perspective

The price is in an ascending movement, the last part of which is consolidation. As consolidations usually continue the movement that preceded them and because in this case before the consolidation an ascending movement can be found, the expectations are for a new upwards leg to be printed.

The upwards movement must find support where to start from. Valid candidates are 0.6855 and the 38.2 projection of the Fibonacci retracement. In this case, the prime target is 0.6933, which corresponds to the 61.8 projection.

Only if 38.2 becomes a resistance, then 23.6 will become the main target.

Levels to keep an eye on:

D1: 0.6800 0.6858 0.7013

H4: 0.6855 0.6933 and the Fibonacci retracement projections of 38.2 61.8 23.6

If you have any questions, comments, or opinions regarding the US Dollar, feel free to post them using the commentary form below.

Original from: www.earnforex.com

No Comments on “Bears Trying to Start an Impulsive Swing from 0.6929”