Home / Forex news / Bulls Back on AUD/NZD from 1.0707?

The Australian versus the New Zealand dollar currency pair seems to be rotated by the bulls. Is this really so?

Long-term perspective

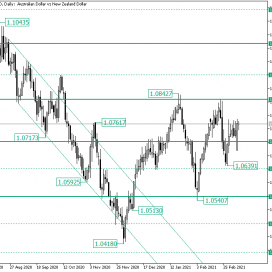

After falsely piercing the firm area of 1.0983 and crafting the 1.1043 high, the price entered into a descending trend that lasted until the inverted head and shoulders pattern — whose head is marked by the 1.0418 low, which also is the lowest point of the depreciation.

The rally that started from the 1.0418 low extended until the 1.0842 high. Noteworthy is that — along this path — the price did not validate the inverted head and shoulder’s neckline as support (1.0551, respectively), paused on reaching the 1.0707 area but continued after the intermediary level of 1.0631 aided the momentum, and then dropped back to the 1.0551 level.

Following the validation of 1.0551, the price climbed back to 1.0826 but, yet again, failed to conquer it. This led to another slide that came to an end just above the 1.0631 intermediary level, at the 1.0639 low. From there, it climbed above 1.0707 and started a consolidative phase.

As the price slipped once more under 1.0707 but quickly recovered, the bulls are the ones to receive the credit. So, as long as 1.0707 keeps its role as support, further rise is just a matter of time, with 1.0826 acting as the first profit booking area for the bulls.

If the bulls capture 1.0826, then 1.0895 is the next area of interest. On the opposite side of the coin sits the possibility of 1.0707 giving way, which, if it does, may allow the bears to send the price to 1.063 and even 1.0551.

Short-term perspective

The rise from the 1.0540 low completed at 1.0827, allowing the decline to the 1.0639 low to form.

Still, the bulls insisted on crafting an appreciation and then a consolidation under the 1.0778 intermediary level. As the low sits a hair away from 1.0681, it can be thought that a direction is to be given after either the resistance or support cedes.

So, if 1.0778 is to be conquered by the bulls, then 1.0826 is their prime short-term target. This may also occur if 1.0681 is validated once more as support — of course, this may happen only after the bears bring the price there after the validation of 1.0741 as resistance.

On the other hand, if 1.0681 cedes, the fall could extend until 1.0621.

Levels to keep an eye on:

D1: 1.0707 1.0826 1.0895 1.0631 1.0551

H4: 1.0778 1.0826 1.0741 1.0621

If you have any questions, comments, or opinions regarding the Technical Analysis, feel free to post them using the commentary form below.

Original from: www.earnforex.com

No Comments on “Bulls Back on AUD/NZD from 1.0707?”