Home / Forex news / Bulls Failing on USD/JPY from 107.00?

The US dollar versus the Japanese yen currency pair seems to lack the power for climbing to greater values.

Long-term perspective

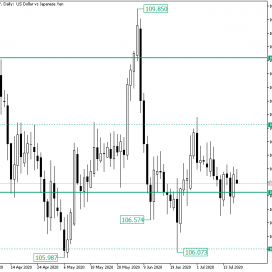

The fall from the 109.85 high extended to as low as 106.07, after a previous bullish attempt to stall it at the 107.00 psychological level, which ended only by printing the 106.57 low.

From the 106.07 low, the bulls did manage a comeback, one that not only pierced and departed from 107.00 but also stretched until the 108.05 intermediary level.

But from 108.05, the price retraced towards the 107.00 level. This price action comes as a natural development, the purpose of it being to validate a support area — in this case 107.00 — from where the next movement to start. Although on June 13, the market noted a bullish engulfing, it did not turn out the way it should, the candle of July 15 invalidating the candlestick pattern.

However, on July 16, the bulls yet again defined a bullish engulfing, but the next candle, still open as of the time of writing, was not able to craft a higher high above the engulfing candle.

So, if the bulls do not manage to send the price above the high of the candle printed on July 16, then still another chance to drive the price towards the north would be wasted. But if they accomplish this, then they could drive the price until 108.05.

Though if the bears take over and send the price beneath 107.00, then they could stamp it as resistance and send the price to 106.12.

Short-term perspective

The rally that started from the 106.07 low ended at the 108.16 high after the price hit the firm 108.02 resistance level.

From there, a descending movement began, noting the support of 107.34, which later became resistance.

Even if the bulls limited any depreciation beyond 106.77, marking a double bottom, as long as the price oscillates under the double resistance outlined by the descending trendline and the 107.34 intermediary level, the bears could send the price to 106.77 and, if they validate it as resistance, to 106.02.

On the other hand, if the bulls pierce the double resistance and confirm it as support, then they could hope for booking their profits at 108.02.

Levels to keep an eye on:

D1: 107.00 108.05 106.12

H4: 107.34 106.77 106.02 108.02

If you have any questions, comments, or opinions regarding the US Dollar, feel free to post them using the commentary form below.

Original from: www.earnforex.com

No Comments on “Bulls Failing on USD/JPY from 107.00?”