Home / Forex news / Bulls on USD/JPY Regrouping from the 107.00 Handle?

The US dollar versus the Japanese yen currency pair oscillates around the 107.09 level. Is there a lack of direction?

Long-term perspective

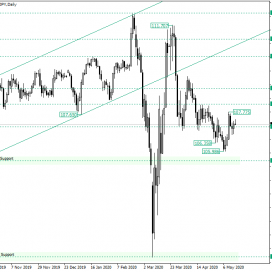

The depreciation that started from 111.07, and which came after the strong rally that begun after the price touched the monthly support of 101.18, seemed to have found support at the 107.09 level.

But the 107.09 support was breached on April 28, allowing the price to fall until the low of 106.35. From there, a throwback confirmed the same 107.09 as resistance, fueling the extension until 105.98.

Getting that close to the weekly level of 105.55 may have been too daring for the bears, as the bulls projected the price back above the 107.09 level an etched the 107.77 high.

The following retracement is now searching for a support level, and 107.09 could just be the right candidate for this task. Until now, it has done a very good job, as the candle of Mat 14 closed above this level.

So, as long as the price oscillates above 107.09, further advancement towards the north is to be expected, with 108.13 serving as the first target and 108.85 as the second.

Only if the price slips under the 107.09 level, then the bears might get the chance to confirm it as resistance, a scenario in which a new fall towards 105.55 may be in the cards.

Short-term perspective

The appreciation that started from the 105.98 low pierced the descending resistance trendline that starts from the peak of 109.06.

The price then reinspected the pierced trendline, confirming it as support and heading for a new run to higher prices, pausing at the 107.38 level. In doing so, it also crafted a new higher low, that now defines the ascending trendline that starts from 105.98.

So, as long as the price remains above the trendline, the bulls are behind the wheel, with 107.92 as a first stop, and 108.43 as the second.

However, if the price fails to confirm the double support noted by the ascending trendline and the 107.06 level, then the bears could drive the price to 106.41.

Levels to keep an eye on:

D1: 107.09 108.13 108.85 105.55

H4: 107.06 107.92 108.43 106.41

If you have any questions, comments, or opinions regarding the US Dollar, feel free to post them using the commentary form below.

Original from: www.earnforex.com

No Comments on “Bulls on USD/JPY Regrouping from the 107.00 Handle?”