Home / Forex news / Bulls Still Fighting over the 0.6800 Level on AUD/USD

The Australian dollar versus the US dollar currency pair looks as if it is under bearish control, but bullish sings are also in the loop.

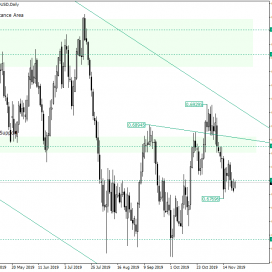

Long-term perspective

After peaking at 0.6929, the price depreciated and printed a low at 0.6769. Alongside this movement, it interacted with two levels.

The first level, the major support of 0.6858, was not able to halt the drop, as the price passed it with relative ease.

On the other hand, the second level — the psychological 0.6800 — caused a rotation, which led to four candles closing above it.

But as the bears seem to be very decisive, the next two days — November 21 and 22, respectively — closed under 0.6800. However, noteworthy is that the candle on November 22 is an inverted hammer, a candlestick pattern that has the potential of starting a bullish movement

But for the bulls to continue their way towards higher prices, it is very important that this pattern is confirmed. This translates into a candle — preferably the one that follows the inverted hammer — that closes in a bullish manner and — even better — above 0.6800.

Of course, another possibility is for another strong bullish pattern — like a bullish pin-bar — to be printed.

Irrespective of which scenario materializes, any bullish continuation will eye 0.6858.

On the other hand, if the low of 0.6969 is taken out, then a confirmation of 0.6800 as resistance is to be expected, targeting 0.6700.

Short-term perspective

The bump and run was not able to sustain any bullish advancement, but what is interesting is that the price is oscillating on the resistance of the chart pattern.

If the price confirms the Fibonacci retracement level of 23.6 as support, 38.2, and 0.6855 will serve as targets.

But if the price confirms 23.6 as resistance, then 0.6746 will be revisited. If from there the price manages to confirm 23.6 as support, then this will represent a message that the bulls are back. If not, further advancement towards the south would be seen.

Levels to keep an eye on:

D1: 0.6800 0.6858 0.6700

H4: 0.6855 0.6746 and the Fibonacci retracement levels of 23.6 38.2

If you have any questions, comments, or opinions regarding the US Dollar, feel free to post them using the commentary form below.

Original from: www.earnforex.com

No Comments on “Bulls Still Fighting over the 0.6800 Level on AUD/USD”