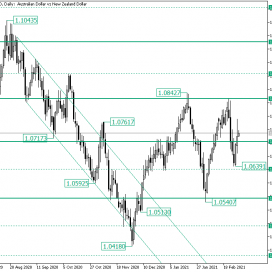

Home / Forex news / Bulls Targeting 1.0826 on AUD/NZD?

The Australian versus the New Zealand dollar currency pair seems to have been taken by from the bearish hands. Will the bulls be able to maintain the momentum?

Long-term perspective

The fall from the 1.1043 high, even if it started as a false piercing of the 1.0983 firm area, ended up forming a descending trend that took the price to the 1.0418 low.

However, after the bulls crafted the inverted head and shoulders pattern with the neckline noted by the 1.0551 level, they managed to finish the bearish dominance.

Following their initial goal — to get the price out of the declining trend — the bulls climbed until the 1.0707 level. Because from the 1.0513 low — which is the starting point of the rally — unto the 1.0707 level, the bulls did not secure any support area, they needed to check one, and as the closest available level was the 1.0631 intermediary, they used it to fasten their next step.

This is how they made it to the 1.0842 high, which sits just above the 1.0826 area. The bears sprang into action, diving the price all the way back to the neckline of the inverted head and shoulders pattern, even succeeding in piercing it.

Nevertheless, the bulls used this event to their advantage, rendering the 1.0540 as part of a false piercing and, thus, validating the neckline. This allowed for a rally that took the price back to 1.0826.

From there, the bears made another effort, but the history repeated itself, only that this time the 1.0631 area — highlighted by the 1.0639 low — was the one to come to the bulls’ aid — sending the price above 1.0707.

So, as long as the price oscillates above 1.0707, the appreciation may continue — with 1.0826 acting as the first bullish profit booking area. Only if 1.0707 cedes, then 1.0631 — and possibly 1.0551 — is to be paid a visit.

Short-term perspective

From the 1.0540 low, the price climbed until the 1.0827 high. After the firm 1.0820 level proved to keep its role as a resistance, the price ebbed until the 1.0639 low.

Still, from there, the price managed to climb above the 1.0681 intermediary level, validate it as support, and continue till 1.0741.

If the momentum is conserved and the bulls conquer 1.0741, then 1.0778, followed by 1.0820, are the next bullish objectives.

On the flip side, if 1.0741 remains a resistance zone, the price may retrace to the 1.0681 level.

Levels to keep an eye on:

D1: 1.0707 1.0826 1.0631 1.0551

H4: 1.0741 1.0778 1.0820 1.0681

If you have any questions, comments, or opinions regarding the Technical Analysis, feel free to post them using the commentary form below.

Original from: www.earnforex.com

No Comments on “Bulls Targeting 1.0826 on AUD/NZD?”