Home / Forex news / Can AUD/USD Recover 0.6313?

The Australian dollar versus the US dollar currency pair seems to be in bullish hands. Are the bears just around the corner?

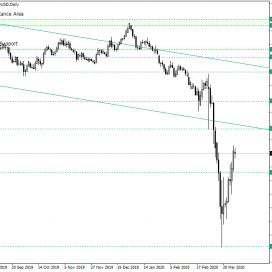

Long-term perspective

After the Head and Shoulders with the neckline at the 0.6851 major support level played out, the price depreciated in a very pronounced manner, extending until the level of 0.5511.

From there, a retracement equally as strong as the depreciation manifested itself, leading the price above the 0.6015 level.

In one scenario, the price could simply continue to print bullish candles until it reaches and confirms as support the 0.6313 level. In this case, the 0.6500 psychological level is the first target, and 0.6700 follows it.

In a second scenario, which is bullish also, the price retraces to confirm a support level. That level could be 0.6015 or even 0.6100 — the latter is not highlighted on the chart. The first target for this unfolding is 0.6313, followed by the ones of the first scenario.

On the other hand, the price could fall back under 0.6015, a situation in which the market turns neutral.

Short-term perspective

The descending movement that started from the peak of 0.6684 extended to as low as 0.5506. From the low, the price went back above the 0.5666 level and, after further consolidation, managed to win 0.5971 and almost touch the 0.6231 resistance level.

But there are also two important aspects of interest concerning this appreciation. The first one is that the resistance trendline that starts from 0.6684 was pierced and confirmed as support around the low of 0.5869 (on March 24), thus serving for the bulls (on March 26) as a local support area from where they drew a new upwards pointing leg and also printing the low of 0.5869.

The second one is represented by the wedge formation. Usually, if it is pointing up and preceded by a downwards movement, like the one from 0.6684, then it indicates that the depreciation has the likelihood of continuing. However, as the resistance line of the chart pattern was pierced, chances are that this is a strong bullish market, one that is to continue, at least for a while.

In this context, the first scenario is the one in which the price gets above and confirms 0.6231 as support. A prime target in such a case is represented by 0.6363, while the second one is 0.6497.

The secondary scenario is the one in which the price comes back towards the 0.5967 level to confirm it as support. If it does, then 0.6231 is the first target. Noteworthy is that the price could extend until the low of 0.5869, but if the price can get back again over the 0.6231 level, then the bullish scenario remains viable.

Only if the low of 0.5869 is taken out, then 5.666 can become the next purpose for the price.

Levels to keep an eye on:

D1: 0.6313 0.6500 0.6700 0.6015

H4: 0.6231 0.6363 0.6497 0.5967 0.6231 0.5666 and the low of 0.5869

If you have any questions, comments, or opinions regarding the US Dollar, feel free to post them using the commentary form below.

Original from: www.earnforex.com

No Comments on “Can AUD/USD Recover 0.6313?”