Home / Forex news / Copper gearing up for potential break out

Following Donald Trump’s speech on Wednesday, crude oil and gold both fell after the US President made no mention of military action against Iran and called for peace and negotiations. While these commodities fell, the more risk-sensitive copper rallied along with stocks. The base metal has been trending higher in recent months on signs of stronger demand, with investors pricing out the risks of a global slowdown. This is mainly due to growing optimism that the US and China will soon end their damaging trade war. The two sides are set to sign phase one of the deal in a few days’ time and then immediately start phase 2 talks. A trade agreement will help boost Chinese exports to the US and underpin the yuan, which in turn means more buying power of foreign goods and services for Chinese producers and consumers alike. Meanwhile data in the US has remained resilient while in the Eurozone we have seen some mild improvement too.

Source: Trading View and FOREX.com. Please note this product may not be available to trade in all regions.

Source: Trading View and FOREX.com. Please note this product may not be available to trade in all regions.

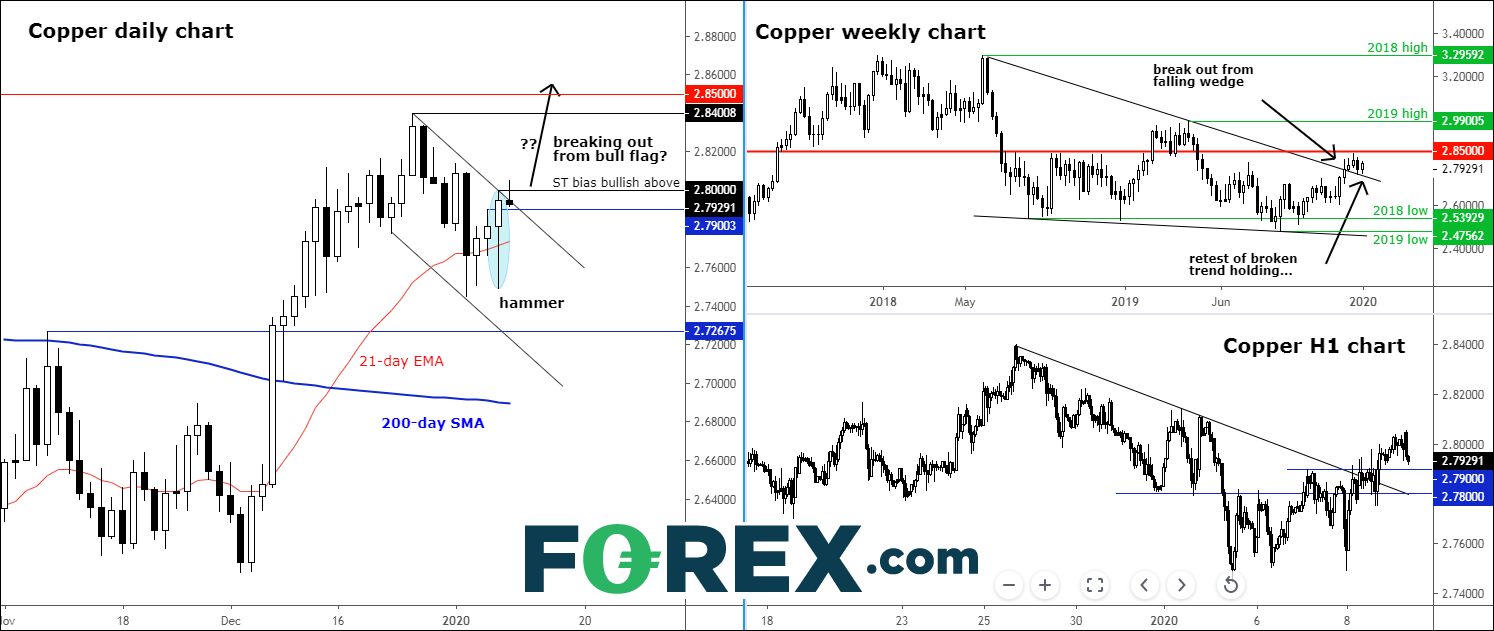

Thanks to this fundamental backdrop, copper has been displaying bullish price action on multiple time frames of late. On the weekly, for example, it has broken out of a falling wedge pattern at the back end of last year, and the retest of the resistance trend has held as support at the start of this year. Now, copper is trying to break out of a bull flag on the daily chart, after Wednesday’s formation of a nice hammer candle off the 21-day exponential moving average. If successful, a breakout above the recent high of $2.8400 could be on the cards. The bulls will then aim for old resistance around $2.8500 next. However, if this turns out to be a false breakout, and price goes back in the existing range, then in this case we may see a deeper pullback before the bulls have another go at driving copper prices higher at some later point.

Original from: www.forex.com

No Comments on “Copper gearing up for potential break out”