Home / Forex news / Economic Data Will Get Worse. Don’t Wait for it to Get Better.

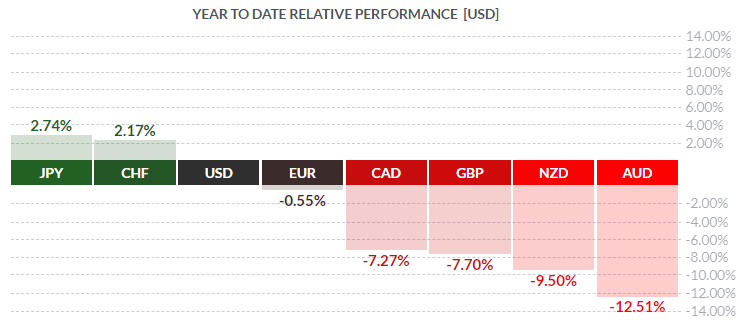

Markets have recovered slightly off the peak pessimism of this morning, but even the bounce from “sheer, unadulterated panic” levels to mere “violently risk averse” prices may not hold for long in the current environment. Major indices have erased Friday’s rally entirely to hit new multi-year lows, yields on the benchmark 10-year treasury bond have been stuck below 1.00% for the past week, and the safe haven currencies (JPY, CHF, and US dollar) are leading the relative strength charts year-to-date, while growth-sensitive currencies like the Australian and New Zealand dollars have fallen sharply:

Source: Finviz

So why are have markets become so volatile, despite economic data holding up relatively well so far?

Well, at the risk of stating the obvious for some readers, it’s critical to remember that the markets are forward-looking. Traders can’t afford to wait for retail sales to fall, unemployment to rise, and economic growth to grind to a halt to sell risk assets. The market is constantly pricing in its best estimate of the future state of affairs in real time.

What does that mean in practice when it comes to coronavirus?

And that will all be highly unsettling, to put it lightly. It’s worth doing your best to prepare for things to get better before they get worse, on both a societal and economic level.

But the fact that markets are forward-looking also has a silver lining: it means that markets and risk appetite WILL improve before the underlying infection, death, or economic data does. This is the fundamental nature of markets. By aggregating the opinions of millions of smart individuals around the globe and incentivizing them to be as accurate as possible, markets can provide one of the most accurate ways to “predict” the future, even if they are imperfect. That’s the reason that the Chinese stock market is one of the best performing indices across the globe year to date.

If you wait for infection and economic data to improve, you’ll miss the majority (if not all) of the recovery.

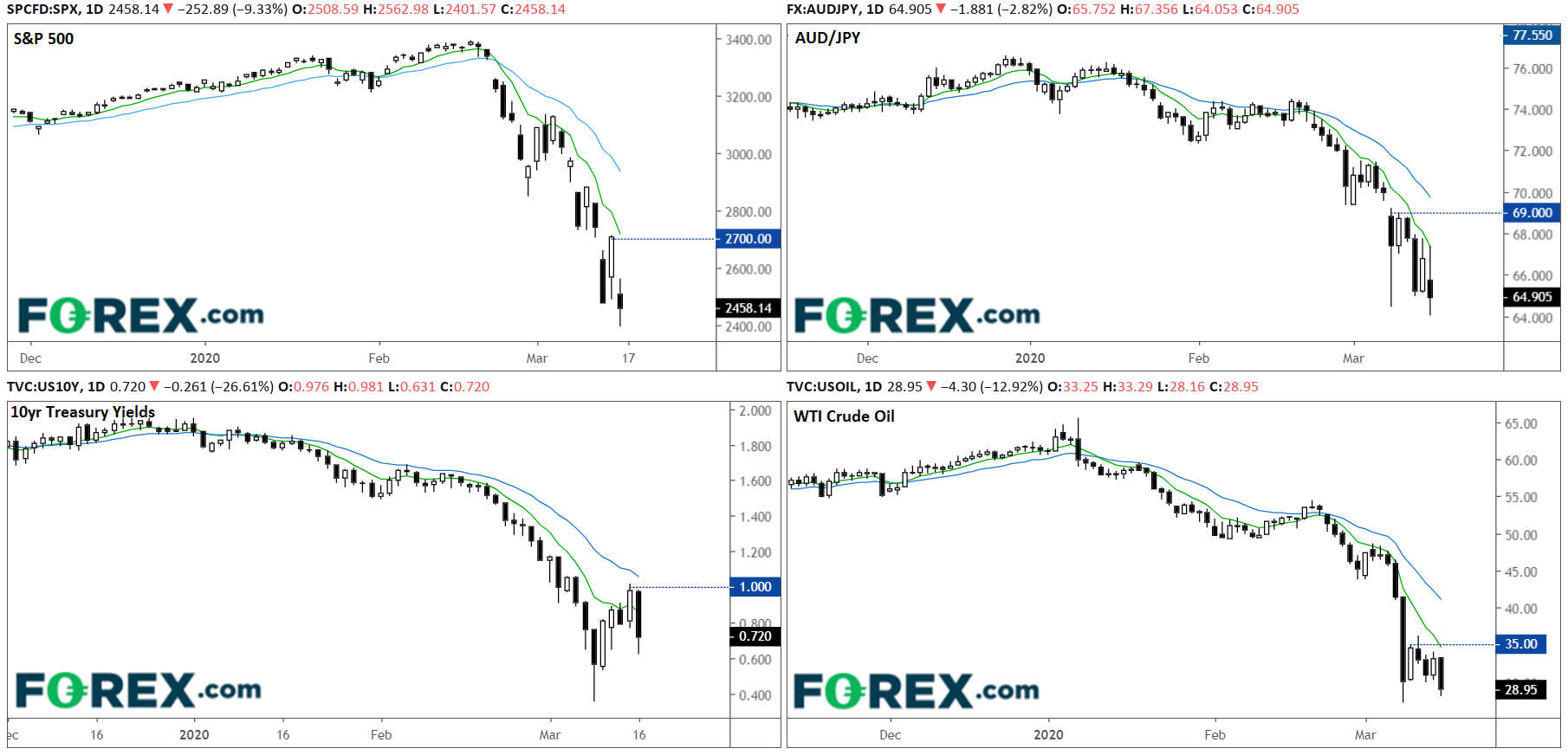

As far as actionable information, we’d encourage readers to take their cues from the broader market. Keying in on the major markets, some short-term signs that could signal a shift back toward a more risk-on environment (or at least stabilization) include the following:

Source: TradingView, GAIN Capital

Astute observers will note that these levels roughly correspond to the 21-day EMA for each instrument. Obviously, these initial levels will evolve if we see another big leg lower in the coming weeks. If we do fall further, then we’ll check back and update these areas, as well as equivalent levels in other markets.

“If you can keep your head when all about you

Are losing theirs and blaming it on you…

If you can force your heart and nerve and sinew

To serve your turn long after they are gone…

Yours is the Earth and everything that’s in it”

– Rudyard Kipling

Original from: www.forex.com

No Comments on “Economic Data Will Get Worse. Don’t Wait for it to Get Better.”