Home / Forex news / EUR/CAD could be heading to new 2019 low

The EUR/CAD remains in a bearish trend and judging by today’s price action, it could end 2019 with a whimper. The euro has failed to respond too positively to a small improvement in Eurozone data of late and remains one of the weakest major currencies of 2019. At the same time, the Canadian dollar continues to ignore weak domestic data to remain one of the strongest major currencies of the year. We think there is a good chance we may see a new swing low in this pair, possibly before the year is out.

So why is the EUR/CAD falling?

Well, as far the euro is concerned, the European Central Bank’s recent decision to restart bond buying to the tune of €20 billion per month means the single currency will struggle to sustain any rebound, even if we see – as we have – some improvement in Eurozone data.

The Canadian dollar, meanwhile, is supported on several fronts. First, the decision by a House committee to clear the USMCA – the new North American trade deal that replaces NAFTA – means it is likely to be approved in the full chamber on Thursday. Second, oil prices have been rising of late thanks mainly to OPEC’s ongoing efforts to restrict supply – this is giving a big boost to the commodity dollar with Canada being the world’s fourth largest oil exporter. Then you have the Bank of Canada, which was nowhere near as dovish in its last policy meeting as had been expected. Finally, the agreement between the US and China to agree to a phase one trade deal has lifted sentiment towards risk assets across the board, including crude oil and Canadian dollar.

Canadian data not so strong

However, there are some concerns over Canadian data, although the latest CPI report, released earlier today, was a touch higher than expected. Though Common and Trimmed measures of CPI were in line at 1.9% and 2.2% y/y respectively, Median CPI beat at 2.4% y/y vs. 2.2% expected and last. Other Canadian data releases have been poor of late, with Manufacturing Sales disappointing on Tuesday, printing a negative 0.7% m/m vs. flat expected. Last week, Building Permits showed a surprise drop of 1.5% m/m vs. a gain of 3.5% expected, while in the week before the monthly employment report showed jobs tanked by 71,200 last month when a rise of 10,00 was expected.

Coming up

Traders bullish on the Loonie will be hoping that the rest of this week’s Canadian data releases will not disappoint. The Canadian ADP Non-Farm Employment Change and Wholesale Sales will be published on Thursday, while Retail Sales are reported on Friday, with headline sales expected to have rebounded +0.5% m/m and core sales seen printing +0.2%.

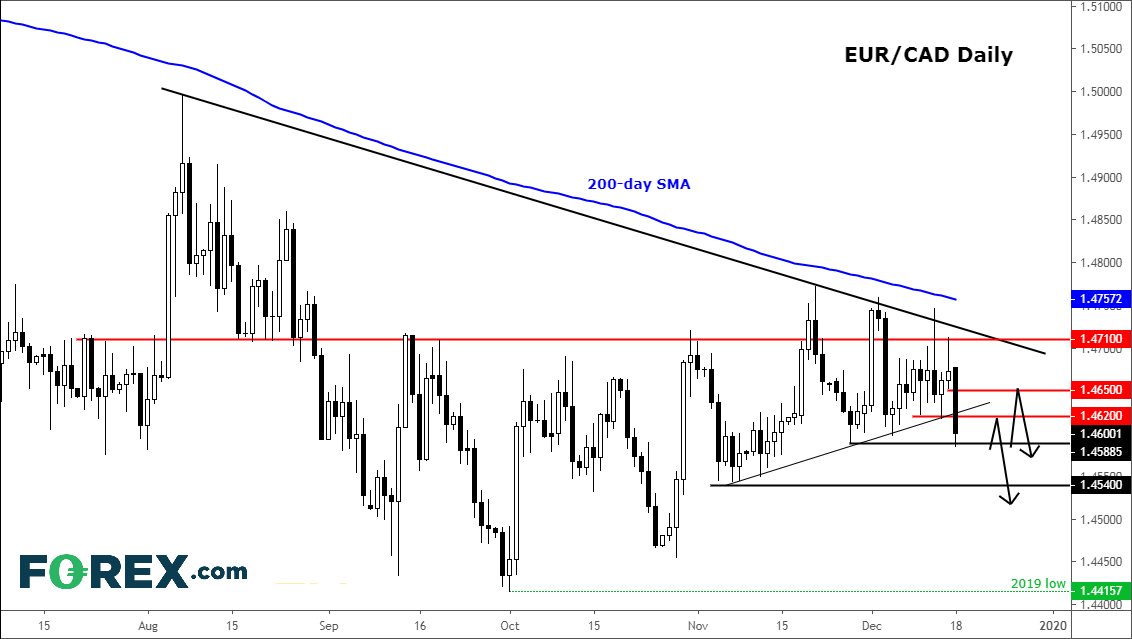

EUR/CAD breaks down

Source: Trading View and FOREX.com

From a technical point of view, the EUR/CAD has broken below a short-term bearish trend line, thus resuming its longer-term bearish trend. Indeed, the long-term trend is negative given that price is holding below the long-term downwardly –sloping trend line and 200-day moving average, among other things. With the path of least resistance being to the downside, we expect resistance levels (such as 1.4620 and 1.4650) to hold and supports (such as 1.4590 and 1.4540) to break down. The bears’ main objective is the liquidity below 1.4415 – this year’s earlier low, hit in early October. We would drop our bearish view on this pair in the event rates break above the bearish trend line and key resistance in the range between 1.3710 and 1.3750.

Original from: www.forex.com

No Comments on “EUR/CAD could be heading to new 2019 low”