Home / Forex news / Falling Trend on USD/JPY Coming to an End?

The United States dollar versus the Japanese yen currency pair seems to be, little by little, moving in bullish territory. Is this really the case?

Long-term perspective

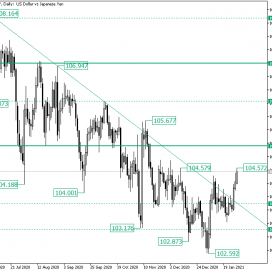

The high of 108.16 is the starting point for the declining trendline that limits the descending trend beneath it, the latter extending until the 102.59 low.

One key difference with the last low is the fact that after it hit the resistance trendline, it failed to produce a determined decline, as the previous one did.

Even more, there are two false piercings, at 106.94 and 105.67, respectively. The high that came about after the rise from the 102.59 low also started to look very similar to a false piercing, having good inception after the bearish engulfing took shape. Still, the lack of bearish interest made it so that the expected decline was halted.

This aided the formation of a flag that facilitated the piercing of the trendline and a relatively strong departure from the 103.74 intermediary level.

As a result, the price rose until the 104.57 high, a higher high if compared to the false piercing that ended up as part of the flag.

So, one possible scenario is the validation of 103.74 as support. Even if it would be a decisive movement, it could also backfire on the bulls, as the bears could send the price under the level.

Another possibility is to see the formation of a short-lived consolidation pattern — like a pennant or a flag — that would, later on, allow further development towards the north.

For both scenarios, the aim is 105.09. However, if the price falls under 103.74, then 103.15 may be paid a visit.

Short-term perspective

From the 102.59 low, the price accelerated to the 104.44 firm area, after it conquered the 103.09 and 103.71 levels, respectively.

As 103.71 became support, the price oscillated above it up until the bearish attempt to change the course, as the low of 103.32 highlights.

Nevertheless, the bulls set the situation back on track, springing a rise to the 104.44 area.

If 104.44 remains resistance, then 103.71 may be checked once more. However, if 104.44 is validated as support, 105.27 is the next bullish objective.

Levels to keep an eye on:

D1: 103.74 105.09 103.15

H4: 104.44 103.71 105.27

If you have any questions, comments, or opinions regarding the US Dollar, feel free to post them using the commentary form below.

Original from: www.earnforex.com

No Comments on “Falling Trend on USD/JPY Coming to an End?”