Home / Forex news / FOMC Preview: Will Powell Open the Door to a Summer Rate Cut?

With traders hyper focused on the latest coronavirus updates and earnings from top-tier technology companies, this month’s Federal Reserve monetary policy meeting is running a bit under-the-radar.

That said, President Trump made sure to remind us all of the event earlier today, disjointedly tweeting “The Fed should get smart & lower the Rate to make our interest competitive with other Countries which pay much lower even though we are, by far, the high standard. We would then focus on paying off & refinancing debt! There is almost no inflation-this is the time (2 years late)!”

Of course, the central bank is unlikely to make any substantive changes to monetary policy tomorrow, with most officials deeming the economic risks balanced after last year’s “mid-cycle adjustment.” It’s also worth noting that this meeting will not feature new economic projections from the central bank, though there will be a press conference with Chairman Jerome Powell. Regardless, we haven’t gotten the full committee’s assessment of the economy since early December, a full seven weeks ago, so traders will still be keen to see how the central bank is viewing developments such as the “phase one” US-China trade deal and the risks from the ongoing coronavirus outbreak.

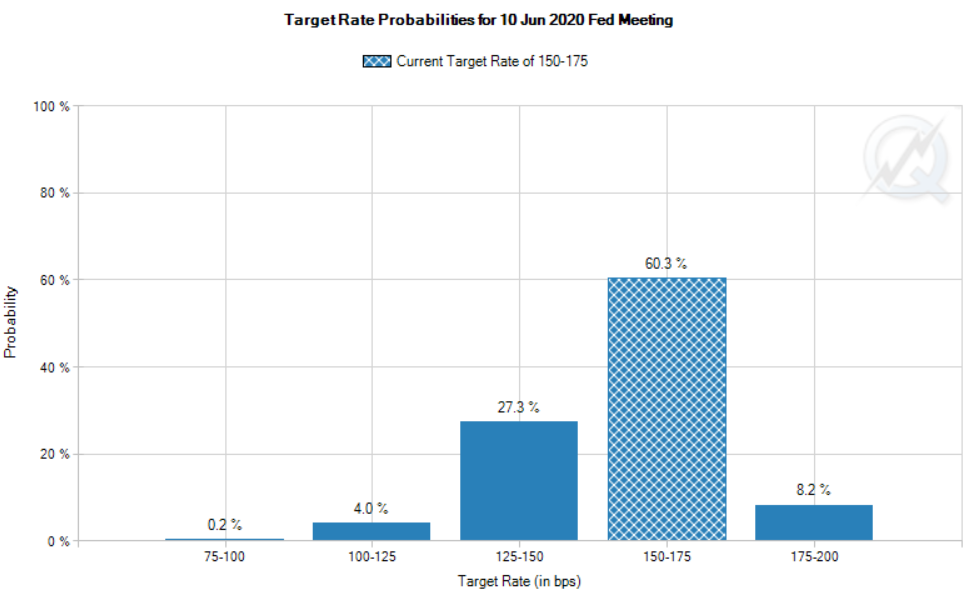

In terms of market pricing, traders are bizarrely pricing in a slight 13% chance of a 25bps interest rate hike at this meeting, according to the CME’s FedWatch tool. Assuming the Fed stands pat as expected, the more relevant figure for traders to watch will be the market-implied odds of a rate cut looking out a bit further, say the June FOMC meeting. As the chart below shows, traders are currently pricing in about a 33% likelihood of an interest rate cut by that time, and the tone of tomorrow’s statement and press conference could prompt traders to adjust their current views:

Source: TradingView, GAIN Capital.

Generally speaking, if Powell comes off as more optimistic on the prospects for the US economy and skeptical of the need for any interest rate cuts, the US dollar could strengthen, potentially at the expense of US stocks. On the other hand, a more cautious, concerned press conference from Chairman Powell could prompt traders to move forward bets on an interest rate cut; this scenario could drive the greenback lower and potentially provide a short-term boost for US stocks.

Original from: www.forex.com

No Comments on “FOMC Preview: Will Powell Open the Door to a Summer Rate Cut?”