Home / Forex news / GBP/CAD Still Aiming for 1.7811

The Great Britain pound versus the Canadian dollar currency seems not to be willing to stray away from its path towards 1.7811.

Long-term perspective

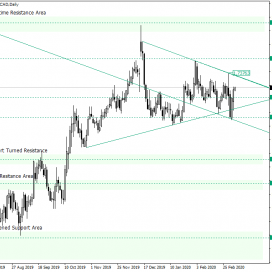

After confirming the level of 1.5936, the price began an appreciation that, starting with late October 2019, seemed to form a symmetrical triangle.

Usually, this chart pattern indicates a continuation, and because in the case of this chart it preceded by an upwards pointing movement, the expectations are for the continuation to march in the same direction.

A first step towards the continuation of the ascending movement is for the resistance line of the triangle to be pierced. But what happened was that the support line got to be priced one. In such a case, it could be considered that the chart pattern — and, of course, its message — are invalidated.

However, because of the fact that the bearish attempt to break the support trendline of the triangle on March 2, was invalidated the next day, it can be said that the invalidation — of the symmetrical triangle — was invalidated — by the bulls quickly recovering on March 3 after confirming the support level of 1.6986.

In doing so, they formed what can be considered an angled rectangle, highlighted on the chart by the two channel lines. As this pattern is in itself a continuation one, the overall message stays the same: the profile is bullish.

So, one possible scenario is for the price to retrace towards 1.7160 to confirm it as support. The second scenario, derives from this one, as the price pierces 1.7160 in order to reach the support trendline of the triangle, confirm it as support, retrace above 1.7160, and confirm this level as support as well.

The target for the two bullish scenarios is 1.7499. Only if 1.6986 turn resistance, then the bullish profile is switched for the bearish one.

Short-term perspective

The price is in an ascending swing. One possible outcome is for the appreciation to continue and conquer the resistance of 1.7288. If this happens, the target is represented by 1.7383.

Another possible unfolding is for a downward swing to come into play and take the price to 1.7130. After the price confirms the level, 1.7288 becomes the first target, being followed by 1.7383.

Levels to keep an eye on:

D1: 1.7160 1.7499 1.6986

H4: 1.7288 1.7383 1.7130

If you have any questions, comments, or opinions regarding the Technical Analysis, feel free to post them using the commentary form below.

Original from: www.earnforex.com

No Comments on “GBP/CAD Still Aiming for 1.7811”