Home / Forex news / GBP/USD Bounced from 1.2092

The Great Britain pound versus the US dollar currency pair corrected from the 1.2100 area. Is this a simple correction of the downwards movement, or is it a bullish comeback?

Long-term perspective

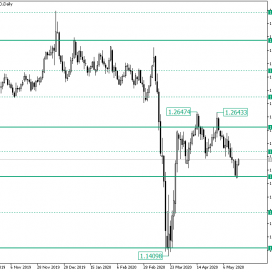

The rally that commenced from the low of 1.1409, after the significant support level of 1.1476 was validated, lost its steam just under the 1.2514 mark.

From there, a consolidative phase took shape, one that was limited by the 1.2514 resistance and the 1.2306 intermediary support.

The bulls attempted two piercings of the resistance, but both ended up as false ones, peaking at 1.2647 and 1.2643, respectively.

The second failed bullish effort favored the bears, as the instilled optimism made then powerful enough to pierce the support and send the price to 1.2092.

However, it seems that this area is well guarded by the bulls, as the fall was met with a rejection that ended up as crystallizing a piercing candlestick pattern, defined by the candles on May 15 and 18, respectively.

So, as long as the 1.2093 support holds, the bulls could be powerful enough to reconquer the 1.2305 level and then the 1.2514 level. For the time being, the latter is their main goal, but if it becomes a support level, then 1.2777 may be the next stop.

On the other hand, if 1.2092 gives way, then 1.1783 serves as an intermediary target, with 1.1476 being the main one.

Short-term perspective

The price is in a descending trend that started from the peak of 1.2643 following the confirmation of the 1.2612 resistance level.

After passing the important support of 1.2282, the price extended until the double support noted by the 1.2111 level and the lower line of the descending channel.

From there, a correction began, one that is now testing the double resistance etched by the 1.2282 level and the upper boundary of the descending channel.

If this double resistance gets pierced, then the bulls could head for the 1.2432 intermediary level, and then after 1.2612.

On the flip side, if the double resistance gets validated, then the price could touch the 1.2111 intermediate support. From there, if the bulls come into play, the price can be conducted back to the 1.2282 resistance, a development that may favor further bullish advancement and targeting the same 1.2432 and 1.2612, respectively, levels.

However, if the price passes 1.2111, then 1.1938 is in the cards.

Levels to keep an eye on:

D1: 1.2093 1.2305 1.2514 1.2777 1.1783 1.1476

H4: 1.2284 1.2432 1.2612 1.2111 1.1938

If you have any questions, comments, or opinions regarding the US Dollar, feel free to post them using the commentary form below.

Original from: www.earnforex.com

No Comments on “GBP/USD Bounced from 1.2092”