Home / Forex news / GBP/USD Encountering Bearish Resistance at 1.3000?

The Great Britain pound versus the United States dollar currency pair seems to limit the bullish efforts. Are the bulls out of steam?

Long-term perspective

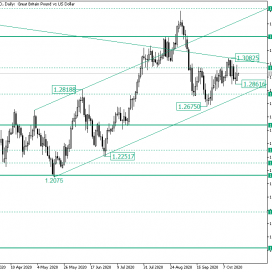

The rally that started from the 1.1476 firm support level extended above 1.2092 but was stopped by 1.2514, leading to a consolidative phase.

This phase printed the low of 1.2075 before validating 1.2092 as support and thrusting to the 1.2818 high.

The retracement that came about from 1.2818, and which also confirmed the intermediate level of 1.2777 as resistance, extended until the 1.2251 higher low, thus setting in place an ascending trend.

The trend aided the bullish enthusiasm, with stopping a hair away from the 1.3502 intermediary level being the result.

However, noteworthy is that the retracement that followed, as the movement which made it happen passed the triple resistance area defined by the descending trendline, the upper line of the ascending channel, and the 1.3261 firm area, ended up as being a false break, instead of a throwback that validates 1.3261 as support.

As a consequence, the bears joined the scene and pushed the price to the 1.2675 low. Of course, being above the lower line of the ascending channel, the 1.2675 low attracted bullish interest.

The outcome was that a new upward movement was printed, but the standing aforementioned triple resistance area seems to halt the bullish advancements.

So, as long as 1.3000 serves as resistance, further depreciation is in the cards, with 1.2777 as the first target and 1.2514 as the second.

On the flip side, if 1.3000 becomes support, then 1.3261 is the first bullish objective.

Short-term perspective

From the 1.2675 low, the price is in an ascending trend, one that managed to extend until the 1.3082 high.

In doing so, the bulls conquered two major levels, 1.2783 and 1.2983, respectively, and the intermediate level of 1.2876.

After printing the 1.3082 high, the price retraced under the upper firm area, only to stop at the intermediate level.

However, even if the intermediary level of 1.2876 backs the bulls, it seems that they cannot retake 1.2983.

If this situation continues, and 12983 joins the bearish side, then 1.2876 may cede, leading the path once more to the lower firm area of 1.2783.

However, if 1.2983 does switch to being support, then 1.3157 is the next bullish aim.

Levels to keep an eye on:

D1: 1.3000 1.2777 1.2514 1.3261

H4: 1.2983 1.2868 1.2783 1.3157

If you have any questions, comments, or opinions regarding the US Dollar, feel free to post them using the commentary form below.

Original from: www.earnforex.com

No Comments on “GBP/USD Encountering Bearish Resistance at 1.3000?”