Home / Forex news / GBP/USD on Its Way to 1.4122

The Great Britain pound versus the United States dollar currency pair seems to be in a phase in which the momentum thrives. Until where will it last?

Long-term perspective

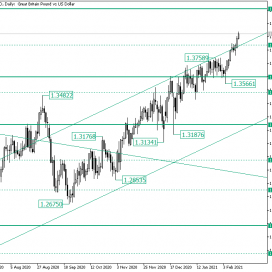

From the 1.3482 high — for the bulls were not able to secure the just pierced triple resistance area made up by the upper line of the ascending channel, the falling trendline, and the 1.3261 level — the price declined until the 1.2675 low.

However, undeterred, the bulls kept sending the price towards the north. As a result, they managed to place it above the resistance that, at the previous attempt, proved to be so hard to conquer — 1.3261.

Of course, the bears were not willing to cede without a fight. So, they tried to set the price under 1.3261. But as the 1.3141 and 1.3287 lows suggest, the bulls were the ones victorious. This enabled the bulls to secure the next key area — 1.3616.

As the upper line of the ascending channel limited further bullish advancement, the bears strived, once again, to get hold of the situation. Still, all they could do was to print a false piercing of the 1.3616 level, for the 1.3566 low marks the starting point of a rally that climbed until the double resistance area etched by the same upper line of the rising channel and the 1.3854 intermediary level.

With the bulls getting above the aforementioned double resistance area, one can expect that the rally will continue. Given the recent developments, two main scenarios may unfold. In the first one, the bulls print a short-term consolidation phase — such as a pennant or a flag — after which they continue toward 1.4122.

In the second plot, the bulls make a throwback to validate the double resistance as support. Even if this act would give credit to the bulls, they may expose themselves, as bringing the price closer to 1.3854 gives the bears courage to attempt a rotation. If this happens and the bears succeed, then we could see 1.3619 once more.

Short-term perspective

During the consolidation phase, limited by 1.3771 as resistance and 1.3652 as support, the bears ventured in turning the situation to their advantage.

Nevertheless, all they could do was craft the 1.3566 low, for the bulls swiftly outmaneuvered them, rendering their efforts as a false piercing and using the gained momentum to clear the resistance — 1.3771.

The validation of the 1.3863 intermediary level as resistance was only a step needed to print a throwback that would confirm 1.3771 as support. Following this, the bulls set the price above 1.3863.

So, as long as 1.3863 remains support, 1.3971 is the next bullish objective, followed by 1.4049. On the flip side, 1.3863 turning resistance exposes 1.3771.

Levels to keep an eye on:

D1: 1.3854 1.4122 1.3619

H4: 1.3863 1.3971 1.3771 1.4049

If you have any questions, comments, or opinions regarding the US Dollar, feel free to post them using the commentary form below.

Original from: www.earnforex.com

No Comments on “GBP/USD on Its Way to 1.4122”