Home / Forex news / GBPAUD Could Challenge 1.9752

The Great Britain pound versus the Australian dollar currency pair seems to try climbing bigger prices. Are the bears in the search for a good spot to short from?

Long-term perspective

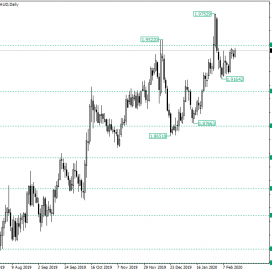

The ascending trend that began after the confirmation of 1.7634 as support, extended until the peak of 1.9752.

From there, it retraced under the previous peak — of 1.9555 — and under the level of 1.9470. The fact that the price went beneath the level, can be seen by the bears as their opportunity to drive it further down.

But the low printed at 1.9164 washes away those bearish thoughts, as it can be seen from the fact that the price appreciated and almost touched the 1.9470 level.

Noteworthy is that the low 1.9164 also confirms as support the peak on January 7, a peak that was part of the false piercing of the 1.9053 level. By confirming as support the high of such an event, the bulls can be sure that they have what they need to drive the prices — at least for a while — where they want. In other words, because this time they managed where they previously failed, entitles the bulls to mark their presence in the market.

Given this context, the first possible scenario is for 1.9470 to give way. After it is confirmed as support, it may allow an extension that targets the previous high, at 1.9752.

On the other hand, if, in the end, the bulls do not manage to conquer 1.9470, then movements towards the south are to be seen. In such a case, 1.9053 would be a prime target.

Short-term perspective

The price oscillates just above the support of 1.9346. Even if the consolidation phase has 1.9425 — not highlighted on the chart — as resistance, the important resistance level sits at 1.9487.

So, as long as 1.9346 keeps its role as support, 1.9487 may be challenged, and after it is conquered the target will be represented by 1.9752. Of course, until the price reaches that area, the psychological level of 1.9600 — not highlighted on the chart — can serve as an area for the profits to be partially booked.

Levels to keep an eye on:

D1: 1.9470 1.9053 and the high of 1.9752

H4: 1.9346 1.9487 and the high of 1.9752

If you have any questions, comments, or opinions regarding the Technical Analysis, feel free to post them using the commentary form below.

Original from: www.earnforex.com

No Comments on “GBPAUD Could Challenge 1.9752”