Home / Forex news / Gold extends gains as yields and dollar drop

The price of gold was on the rise for the second consecutive day. It found support from three main sources: falling US dollar, bond yields and equity prices. But it remained to be seen whether the metal could break higher with a couple of US equity indices having just hit new record highs just the day before. That said, gold and stocks can rise and have risen in tandem.

So, it may well be yields and the dollar which could determine whether gold can finally break out of its consolidation. Tomorrow’s US jobs report will therefore have a big say in where yields, dollar and in turn gold will be heading. But following this week’s central bank bonanza, bond yields are falling back. Investors are realising that interest rates will remain at historically low levels for a sustained period of time, due to a slowing global economy. Against this backdrop, safe-haven gold prices remain fundamentally supported.

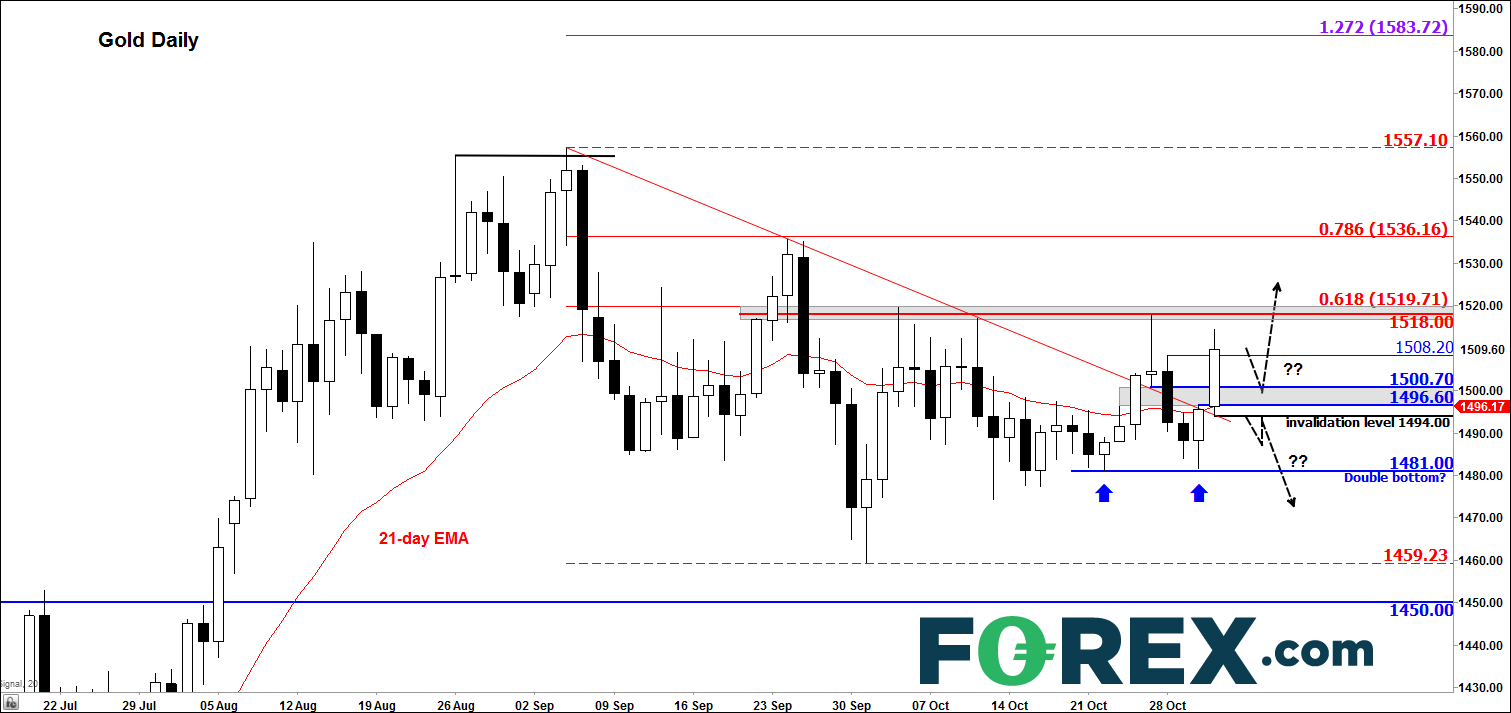

Source: eSignal and FOREX.com.

Meanwhile, the technical picture is beginning to improve again for gold, following the metal’s breakout above its short-term bearish trend. As a reminder, gold’s longer-term technical outlook is also positive after it broke out of a 6-year consolidation pattern in the summer. This is why I keep focusing on shorter-term bullish rather than bearish developments, when they occur. Currently, the metal is holding its own above the short-term bear trend, the 21-day exponential and short-term pivotal zone between $1496 and $1500. For as long as this region gets defended, the bulls will remain happy. However, a closing break back below this zone and the probability of a sharp correction would increase again.

Original from: www.forex.com

No Comments on “Gold extends gains as yields and dollar drop”