Home / Forex news / Looks like AUD/NZD Targets 1.0530

The Australian dollar versus the New Zealand dollar currency pair appears to be in bullish hands, even if the bears did all they could to send it towards the south.

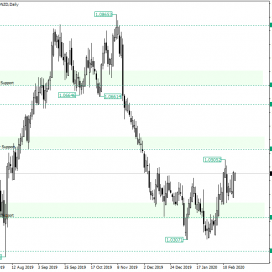

Long-term perspective

After the confirmation of 1.0837 as resistance, the price started a strong depreciation that reached the area of 1.0361.

Along this way, two important levels gave way: the weekly support of 1.0689 and the monthly support of 1.0640, respectively.

But the next support, the weekly 1.0361, decided not to let go without a fight. And so it did, as the bearish attempts were met with strong opposition.

The bears managed to print the low of 1.0307, but that was as close as they could get to piercing the 1.0361 support. After February 5, closed above the level, the bulls knew that they are in control.

The result was the high of 1.0505, which took out all the highs that formed after the price lost the downwards momentum from 1.0865.

One possible scenario is the one in which the price makes a throwback towards the weekly support of 1.0361 to confirm it as support once and for all — in the context, of course, of the bullish to bearish battle that rages since December 2019. This should be a very short-lived event — not more than two days — as otherwise it could be considered that the bulls lack the power to drive prices higher after a retest of 1.0361.

Another scenario is the one in which the price continues to oscillate above the green box that sits above the 1.0361 level, thus sitting in an area from where a rally is just a matter of time.

For both scenarios, the target is represented by the resistance level of 1.0505.

Short-term perspective

After confirming 1.0332 as support, the price extended until the psychological level of 1.0500. The depreciation that followed was limited by 1.0404, which favored the price to get above 1.0440.

As long as the price movements unfold above 1.0440, further appreciation is in the cards, the main target being 1.0500.

However, if 1.0440 gives way, then the bulls may recharge from 1.0368, aiming for the same target.

Levels to keep an eye on:

D1: 1.0361 1.0530 1.0277

H4: 1.0440 1.0500 1.0368

If you have any questions, comments, or opinions regarding the Technical Analysis, feel free to post them using the commentary form below.

Original from: www.earnforex.com

No Comments on “Looks like AUD/NZD Targets 1.0530”