Home / Forex news / NFP Preview: Did Powell Just Steal the Jobs Report’s Thunder?

Every month, we remind traders that the Non-Farm Payrolls report is significant because of how it impacts monetary policy. In other words, the Fed is the “transmission mechanism” between US economic reports and market prices, so any discussion about NFP should start with a look at the state of the US central bank.

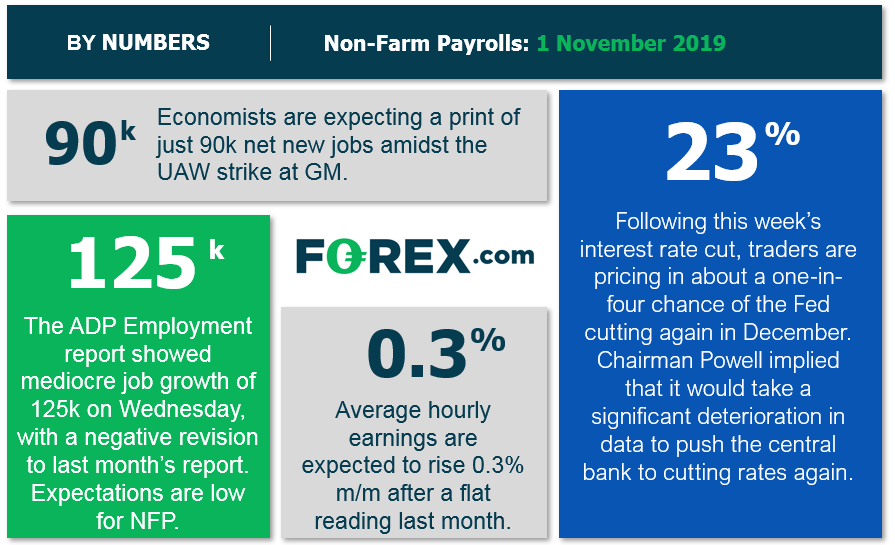

Like a bridesmaid announcing she’s pregnant at the wedding, Fed Chairman Powell may have upstaged the NFP report by stating that it would take a “material reassessment” of the central bank’s outlook for the economy to cut interest rates again…and that it would take a “significant rise” in inflation to start raising interest rates. In other words, there’s a high bar to changing Fed policy from neutral any time soon, and with that transmission mechanism busted, the NFP report may lead to less volatility than normal.

NFP Forecast

In addition to the potential for a quieter market reaction than normal, two of our four most reliable “leading” indicators for the jobs report (the ISM Manufacturing and Non-Manufacturing Surveys) will be released after tomorrow’s jobs report. The two other leading indicators printed as follows:

The ADP Employment report dropped to 125k, meeting estimates, though the previous month’s report was revised down to just 93k.

The 4-week moving average of initial unemployment claims rose to 214,750 from last month’s reading of 212,500.

Both of these leading indicators have taken a turn for the worse, and there’s one more big bearish factor at play in this month’s reading: the United Auto Workers strike at General Motors. The strike (which was just resolved last week) impacted 46,000 workers across 55 facilities in 10 states, raising the likelihood of a sub-100k reading in Non-Farm Payrolls for only the third time in the last two years.

Regardless, the month-to-month fluctuations in this report are notoriously difficult to predict, so we wouldn’t put too much stock into any forecasts (including ours). Most importantly, readers should note that the unemployment rate and (especially) the wages component of the report will also influence how traders interpret the strength of the reading.

Source: FOREX.com

Potential Market Reaction

See wage and job creation scenarios, along with the potential bias for the USD dollar below:

Earnings < 0.2% m/m

Earnings 0.2-0.3% m/m

Earnings > 0.3% m/m

< 75k jobs

Bearish USD

Neutral USD

Neutral USD

75-125k jobs

Slightly Bearish USD

Neutral USD

Slightly Bullish USD

> 125k jobs

Neutral USD

Neutral USD

Bullish USD

In the event the jobs and the wage data beat expectations, then we would favor looking for short-term bullish trades in USD/CAD, which has seen a significant bounce on the back of weak oil prices and a dovish Bank of Canada press conference. But if the jobs data misses expectations, then we would favor looking for bearish setups on the dollar against the yen, which is turning lower off key resistance in the 109.00 area.

Original from: www.forex.com

No Comments on “NFP Preview: Did Powell Just Steal the Jobs Report’s Thunder?”