Home / Forex news / NFP Preview: Stale Jobs Figures Could Mask the Full Brunt of COVID-19’s Disruption

Background

Usually in this introduction, we explain that the Non-farm Payrolls report is significant because of how it impacts monetary policy. Under normal circumstances, the Federal Reserve is the “transmission mechanism” between U.S. economic reports and market prices, so any discussion about NFP should start with a look at the state of the U.S. central bank.

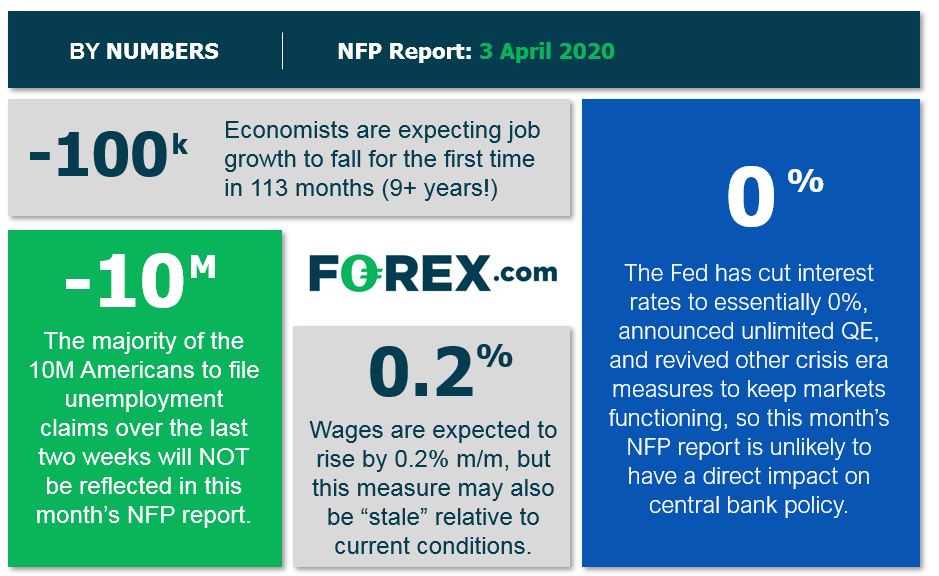

Like every other aspect of American (and global) life, COVID-19 has sundered that relationship. Over the last month, the Federal Reserve has cut interest rates to essentially 0%, announced an unlimited Quantitative Easing program, and reintroduced many of the GFC-era measures to ensure markets continue to function; all of these measures are likely to remain in place for the foreseeable future. In other words, Fed policy isn’t particularly sensitive to US labor market data in the current environment.

That said, the Non-Farm Payrolls report still paints a broad picture of the state of the US labor market, and as such, will provide key insight to traders. At this point, it’s worth noting that the BLS’s estimate of jobs is derived from two surveys conducted in the week that contains the 12th of the month (March in this case), so much of the recent disruptions in the labor market (including the unprecedented 10M in unemployment claims over the last two weeks) will NOT appear in this month’s NFP report.

NFP Forecast

From our perspective, there are four historically reliable leading indicators for the NFP report, but given the vagaries of the calendar this month, we won’t have access to the ISM Non-Manufacturing reading until after Friday’s release:

In other words, the leading employment indicators universally deteriorated this month, and if anything, likely understate the current situation in the US labor market; that being the case, the NFP report will likely do the same, so we can still take a stab at estimating the release. Needless to say, traders should take any forward-looking economic estimates with a massive grain of salt given the unpredented global economic disruption as a result of COVID-19’s spread. Weighing the data and our internal models, the data points to a potentially stronger-than-expected jobs report, with headline job growth in the 0-100k range, albeit with a bigger band of uncertainty given the possible early impact from coronavirus on manufacturing employment. Note that this doesn’t mean that the US is still adding jobs today, only that the data may be stale and reflect conditions from early March, when COVID-19’s disruption to economic activity was relatively smaller.

Regardless, the month-to-month fluctuations in this report are notoriously difficult to predict, so we wouldn’t put too much stock into any forecasts (including ours). Most importantly, readers should note that the unemployment rate and (especially) the wages component of the report will also influence how traders interpret the strength of the reading.

Source: GAIN Capital

Potential Market Reaction

See wage and job growth scenarios, along with the potential bias for the U.S. dollar below:

Earnings < 0.2% m/m

Earnings = 0.2% m/m

Earnings > 0.2% m/m

< -200k jobs

Bearish USD

Slightly Bearish USD

Neutral USD

-200k – 0 jobs

Neutral USD

Neutral USD

Neutral USD

0+ jobs

Neutral USD

Neutral USD

Slightly Bullish USD

In the event the jobs and the wage data beat expectations, the market may nonetheless view the data as stale, so any bullish reaction in the US dollar may be short-lived. Nonetheless, a better-than-anticipated jobs report could prompt the US dollar to extend its recent uptrend against the euro, so traders expecting decent data may want to consider short trades in EUR/USD. As always, USD/JPY may see the “cleanest” reaction to a weak NFP report, with the potential for the pair to resume last week’s drop as traders favor the yen’s “safe haven” properties over the US dollar.

Original from: www.forex.com

No Comments on “NFP Preview: Stale Jobs Figures Could Mask the Full Brunt of COVID-19’s Disruption”