Home / Forex news / NZD/CAD Back Above the Weekly Support of 0.8344

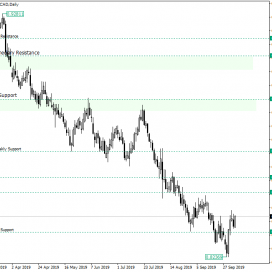

The New Zealand dollar versus the Canadian dollar currency pair managed to reconquer the important 0.8344 level.

Long-term perspective

The decline that started at 0.9281 managed to pierce the important support of 0.8344, but the bulls were very determined, printing the low of 0.8236 and then driving the price back above it. They did so by etching a bullish engulfing on October 2. The fact that this puncture was invalidated by such a strong pattern leads to the idea that the chances of the price getting back bellow 0.8344 are slim in the absence of a strong fundamental catalyst.

Another reason for the bulls to count on the market as being on their side is the invalidated shooting star on October 4, which also is a higher-high in relation with the high on September 25 and thus serves as a reason for the bears to stay aside.

So, as long as the price oscillates above 0.8344 — and of course the psychological 0.8400 — the profile remains bullish, targeting 0.8514 first and then 0.8692.

Short-term perspective

The market printed an inverted complex head and shoulders, with two shoulders on the left-side — 0.8295 and 0.8305, respectively — and one, at the time of writing, for the right-side at 0.8360. The first development in order for this chart pattern to work out is for 0.8437 to be taken out. Then, as 0.8417 is confirmed as support, the market can reach 0.8516.

It is also possible for the chart pattern to print another shoulder, but if it extends beyond 0.8360, then this could be a sign that the bears are winning. If that is the case, then a first target is represented by 0.8300, and then 0.8250 which serves as the support level for the head.

Levels to keep an eye on:

D1: 0.8344 0.8514 0.8692

H4: 0.8417 0.8516 0.8300 0.8250

If you have any questions, comments, or opinions regarding the New Zealand Dollar, feel free to post them using the commentary form below.

Original from: www.earnforex.com

No Comments on “NZD/CAD Back Above the Weekly Support of 0.8344”