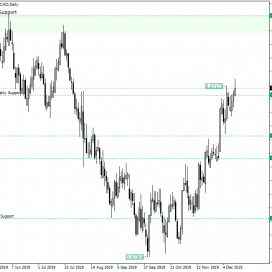

Home / Forex news / NZD/CAD May Have the Path to 0.8915 Open

The New Zealand dollar versus the Canadian dollar currency pair appreciated, piercing the 0.8692 resistance. Will the bulls be able to sustain the gains?

Long-term perspective

After departing from the weekly support of 0.8344, the price conquered two intermediate levels — 0.8514 and 08577, respectively — and then headed on for 0.8692.

After the futile bearish attempt to change course on December 9, the bulls succeeded in trading above 0.8684, an event which also took out the previous high at 0.8717, thus printing a higher high which, in turn, gives them an edge.

Even if the bears manage to bring the price back under 0.8692, after such a strong appreciation, they will need some time to rebuild their confidence. In other words, because the bulls are so strong at this point, they have the necessary power to bring the price back above 0.8692 in the event in which it falls under it.

So, as long as the price develops above 0.9286 or falsely pierces it, thus reconfirming it as support, the path to 0.8915 is open, it being the main target. Of course, along the path, the 0.8800 psychological level is an intermediate target.

As mentioned a little earlier, even if 0.8692 is breached, that doesn’t mean that the bears took control, as that happens only if and after 0.8577 is confirmed as resistance.

Short-term perspective

The market is in an ascending movement which, for its entire length, confirmed each support — with a minor exception — with a lot of precision.

Following this behavior, the price could very well pierce 0.8716, make a throwback, and confirm it as support, targeting 0.8782, followed by 0.8825.

On the other hand, if the price does not yet manage to pierce 0.8716 and depreciates until 0.8667, then another appreciation towards 0.8716 is in the cards.

Only if 0.8667 turns to resistance, then the situation changes to neutral.

Levels to keep an eye on:

D1: 0.8692 0.8915 0.8577

H4: 0.8716 0.8782 0.8825 0.8667

If you have any questions, comments, or opinions regarding the Technical Analysis, feel free to post them using the commentary form below.

Original from: www.earnforex.com

No Comments on “NZD/CAD May Have the Path to 0.8915 Open”