Home / Forex news / NZD/CAD on the Way to Higher Prices

The New Zealand dollar versus the Canadian dollar currency pair seems to be determined to continue the upward movement. Should any depreciation be expected?

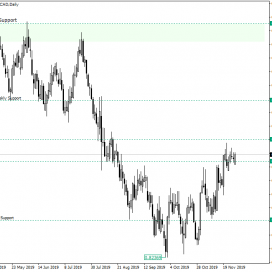

Long-term perspective

After printing the low at 0.8236, the price began crystalizing higher lows and lower highs. This convergence thus took the shape of a continuation pattern. But since eventually, the bears failed to lead a movement towards the south, the bulls confirmed 0.8344 as support.

As a result, 0.8514 was pierced and the price stopped the advancement just before the 0.8577 level.

Afterward, it began a consolidation phase limited by the 0.8514 support and the 0.8577 resistance, respectively.

In such a context, the price is expected to continue with a rally. Joining the market can be made employing a conservative or aggressive approach, respectively.

The conservative approach requires either a false break of the support that concerns the consolidation area, either piercing the resistance and waiting for it to be confirmed as support.

The aggressive method is to enter the market whilst the price is contained in the consolidation area, further away from both support and resistance regions.

The main target area is represented by the 0.8692 resistance level.

Short-term perspective

After confirming the 0.8417 level as support, the price seems to have conquered the 0.8516 level.

As long as 0.8516 does not give way, further advancement is a natural outcome, targeting 0.8600 first, followed by 0.8667.

But even if 0.8516 fails at some point, 0.8417 has the potential to fuel a strong rally and drive the price above 0.8516, yet again.

Only the failure of 0.8417 will signal that the bears are back in business.

Levels to keep an eye on:

D1: 0.8514 0.8577 0.8692

H4: 0.8516 0.8600 0.8667 0.8417

If you have any questions, comments, or opinions regarding the Technical Analysis, feel free to post them using the commentary form below.

Original from: www.earnforex.com

No Comments on “NZD/CAD on the Way to Higher Prices”