Home / Forex news / OIL MARKET WEEK AHEAD: Corroding Virus

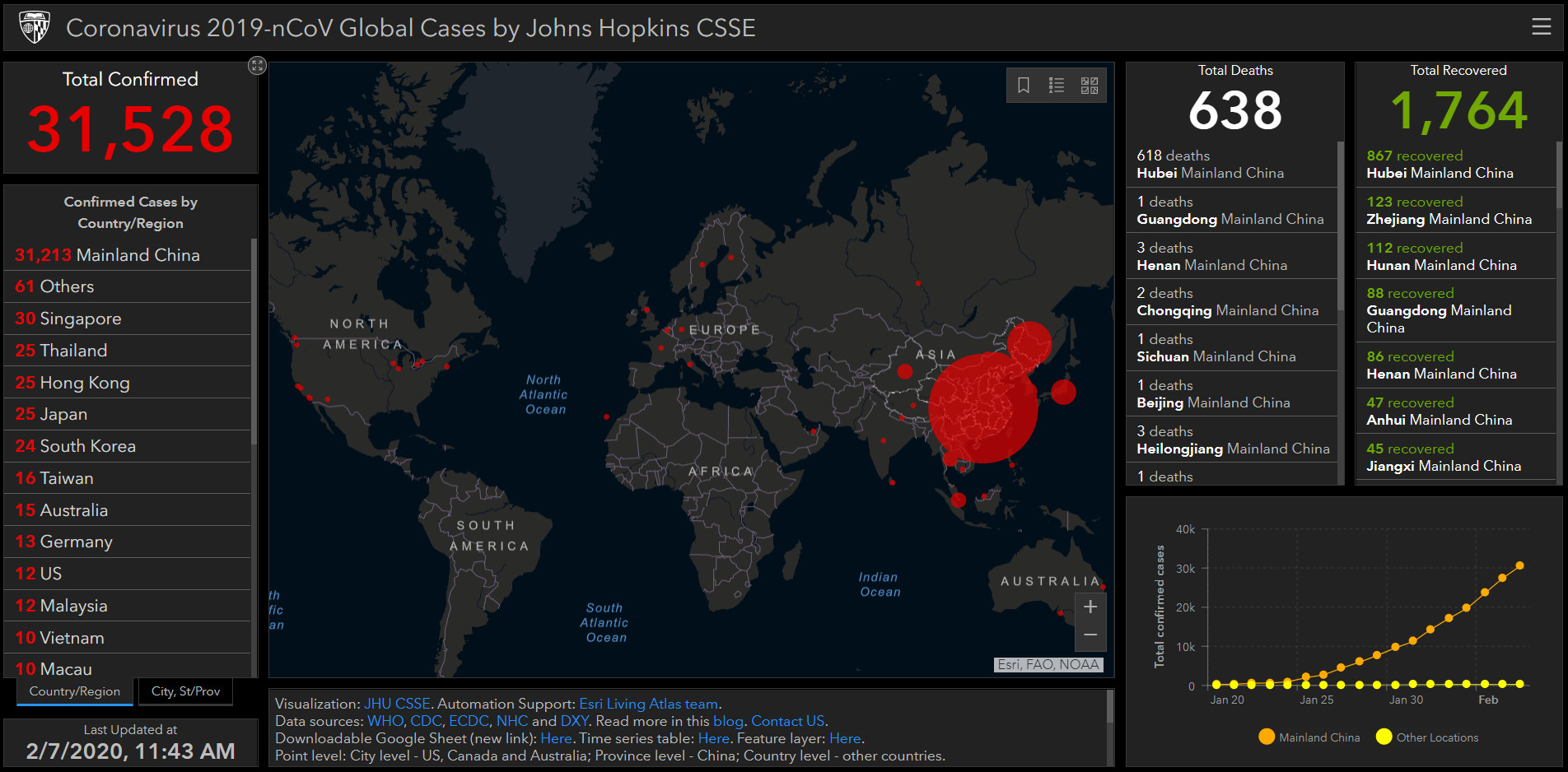

The coronavirus is continuing to grind down the oil market, and despite a brief pickup in prices towards the end of the week, there isn’t a quick resolution in sight. There was much hopeful talk about a vaccination that could be available soon, but the Coalition for Epidemic Preparedness Innovations which is currently working on developing the medicine splashed cold water on those hopes saying that it could take six to eight months to put a viable medical solution in place.

Nevertheless, there are signs that life in parts of China outside the worst affected area is starting to regain some normality. The government told businesses outside Hubei Province to resume operations, railway and civil aviation authorities were asked to make adjustments for passengers to sit less densely together, and even schools started making preparation to restart the semester, although on a slightly later date.

Source: Johns Hopkins CSSE

Planned OPEC cut may not be enough

OPEC+ seems to be within a whisker of agreeing to cut output by another 600,000 barrels a day to counterbalance the eroding effect of the coronavirus, but it remains to be seen if this will be enough given that China’s oil demand has dropped by 1.4m bbl/d since the outbreak started.

OPEC’s non-executive technical committee debated the effects of the virus for three days this week and eventually came up with the recommendation for a further cut on top of the existing restrictions, a proposal that has yet to be agreed on by Russia. Despite the initial “niet”, Russia is likely to agree to the cuts shortly given past experience, even if it subsequently ignores the production cut anyway. In January alone the country pumped a record 11.3 million bbl.

Country update: Libya

Since the middle of January, Libya has temporarily lost almost 75% of its production as forces loyal to eastern-based commander Khalifa Haftar blocked ports and fields in the east and south of the country. During 2019 and before the January blockade Libya had made big strides in recovering its output, doubling production to 1.097M bbl despite an ongoing conflict between Haftar, who controls the Libyan National Army, and the Tripoli-based government. Next week should see some movement in the status quo as tribal leaders loyal to Haftar submit the list of their conditions for unblocking the oil fields to the UN next Thursday.

Some OPEC producers have been gradually increasing output to plug the gap created by Libya’s lost production, but given the weakness of the overall global demand, Saudi Arabia has maintained a very cautious stance throughout by producing about 400,000 bbl/day below its quota.

When

What

Why is it important

Tuesday Feb 11, 10.00

EC releases economic growth forecasts

A proxy for future European oil demand

Tuesday Feb 11, 13.55

US Feb 7 Redbook index

Strength of US retail demand

Tuesday Feb 11, 21.30

API weekly crude oil stocks

Last at 4.18m

Wednesday Feb 12

OPEC monthly oil report

Producer output levels

Wednesday Feb 12, 10.00

EU Dec industrial production

Down 1.5% y-o-y in Nov

Wednesday Feb 12, 15.30

EIA crude oil stocks change

Indicator of US oil demand

Thursday Feb 13, 13.30

US initial jobless claims

Last at 202,000

Friday Feb 14, 02.00

China January industrial production

First insights into effects of the coronavirus in January

Friday Feb 14, 07.00

Germany Q4 GDP

Germany could be sliding towards recession. Last 0.5%

Friday Feb 14, 10.00

EU trade balance

Car exports, oil imports of interest

Friday Feb 14, 10.00

EU Q4 GDP

Last at 0.1%

Friday Feb 14, 14.15

US Jan industrial production

Recent declines could have been tampered in January

Friday Feb 14, 18.00

Baker Hughes US rig count

Production trend

Friday Feb 14, 20.30

CFTC oil commitment of traders

Money managers positions

Original from: www.forex.com

No Comments on “OIL MARKET WEEK AHEAD: Corroding Virus”