Home / Forex news / OIL MARKET WEEK AHEAD: Is there any shelter from Coronavirus?

Apparently not, is the short answer.

With the first cases recorded in the US and Mexico, investors will be on tenterhooks to see how the illness progresses in the Americas and how much it will disrupt daily life and industrial production. It will also become clear if this week’s panic in the markets was justified. After being through the worst of the virus, China is beginning to return to some sort of normalcy just over a month since the first case was officially reported; businesses are beginning to reopen, and companies are again up and running, although below full capacity.

OPEC Vienna meeting amid sharp price decline

The week ahead will also bring together OPEC countries’ oil ministers in Vienna to discuss not if, but by how much, to cut production to stem the decline in oil prices. Brent crude plunged 13% during the course of last week to trade just below $50/bbl Friday, a level not seen since 2017. Although the OPEC technical committee has been calling for the cartel to extend existing cuts by 600,000, producers may well end up cutting even further. Saudi Arabia plans to export 500,000 bpd less to China in March and is now calling for an overall 1 million barrel cut by OPEC+ countries.

So far Russia has been resisting the push as it is currently facing its own problems. Russia’s stock market index had its worst selloff since 2008, plunging from 1,646 in January to just over 1,300 at the end of this week. For Russia, oil revenue makes up a vast part of its state budget and it may try and shift the burden of cuts to Saudi Arabia and OPEC to inflict the least amount of damage to its domestic economy.

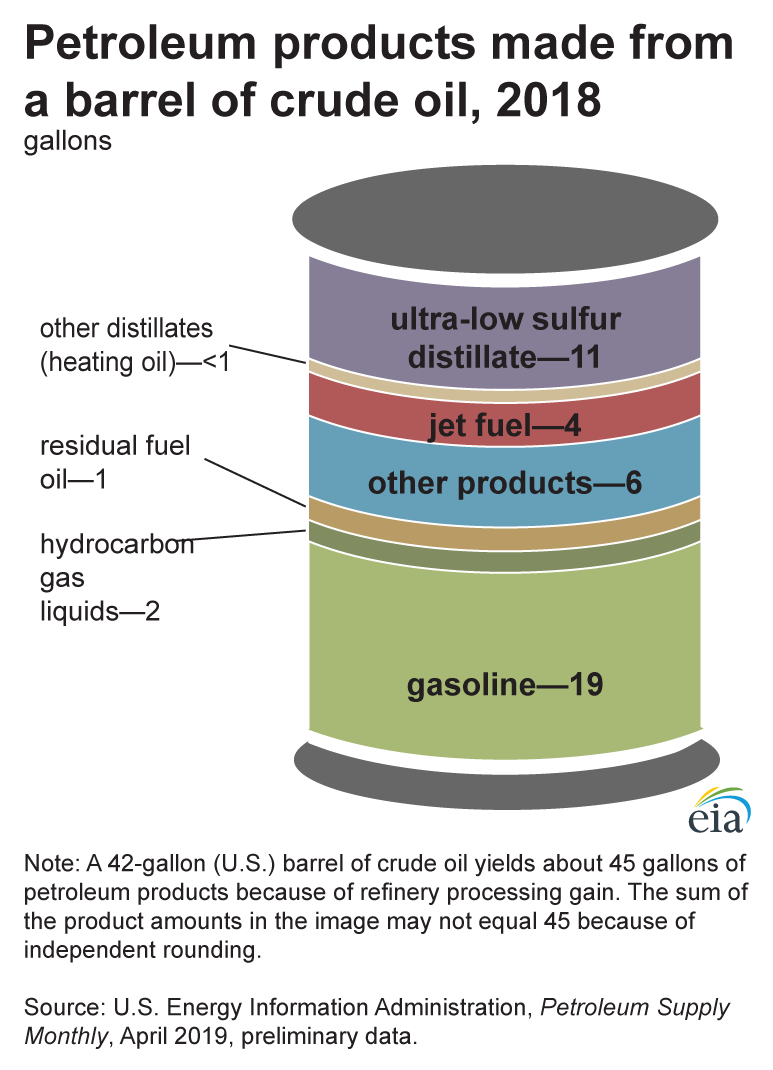

JET FUEL: Suspended flights to China and new suspension to Italy to keep jet fuel low

Apart from the car industry one of the industries hardest hit by the outbreak of COVID-19 has been the airlines. A total of 24 top world airlines have suspended their flights to China and others have modified their flight schedules. British Airways and Air France don’t plan to fly into the country until the end of March, other airlines as far out as the end of June. Some of the flights to South Korea and within the country have been cancelled while some of Iran’s neighbours have suspended flights into and out of the country. Italy has also been on the airlines’ blacklist. With the virus hopping into more and more countries, suspensions will only increase and push the demand for jet fuel even lower. In the first three quarters of 2019 global jet fuel demand stood at around 8m bpd.

What

When

Why is it important

Monday 2 March, 01.45

China Caixin Feb manufacturing PMI

First Chinese manufacturing data for the period covering the spread of coronavirus. January PMI stood at 51.1

Monday 2 March, 08.55

Germany Feb manufacturing PMI

Expected to remain in contraction as in previous months

Monday 2 March, 14.45

US Feb manufacturing PMI

US manufacturing has been skirting just above contraction for the last few months

Tuesday 3 March, 20.30

US vehicle sales

Indicative of future transport demand

Tuesday 3 March, 21.30

API weekly crude stocks

The first weekly indicator of oil stocks ahead of the more reliable numbers by EIA on Wednesday

Wednesday 4 March, 15.30

EIA weekly crude oil stocks

See above. Last week they rose 452,000

Thursday 5 March

Vienna OPEC meeting

Members to discuss output cuts

Thursday 5 March 13.30

US jobless claims

Reflects the strength of the job market and is related to retail spending

Friday 6 March

Vienna OPEC+ meeting

Russia joins OPEC members’ discussion

Friday 6 March 07.00

German Jan industrial production

Correlates to industrial demand for oil in Europe

Friday 6 March 18.00

Baker Hughes US oil rig count

Last at 679, increase of 1 in a week

Friday 6 March 20.30

CFTC net oil positions

Changes in money managers’ oil positions

Original from: www.forex.com

No Comments on “OIL MARKET WEEK AHEAD: Is there any shelter from Coronavirus?”