Home / Forex news / OIL MARKET WEEK AHEAD: New Shipping Fuel Regulations to Hit Oil Markets from January 1

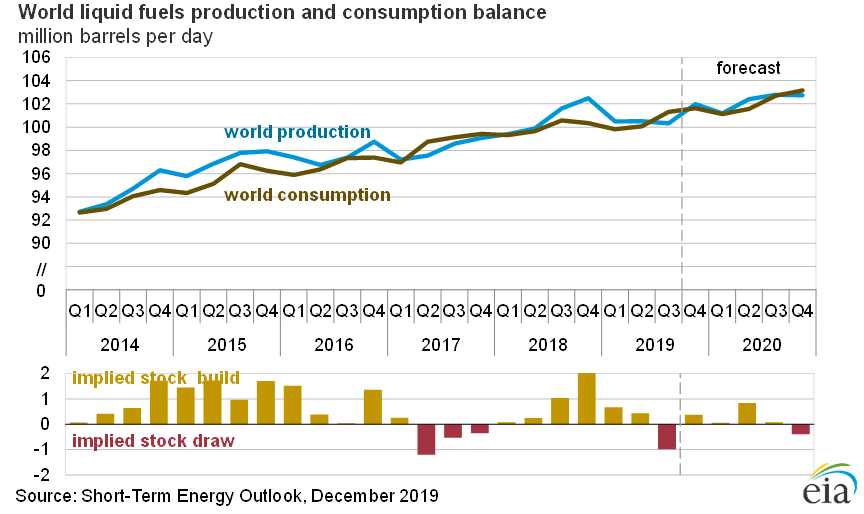

Whether the slight shift in the trade balance between the US and China over the last few months represents a sustainable long-term trend remains to be seen, but what is definite is that in September, the US – for the first time – exported more oil than it imported. These exports are contributing to an expected increase in global oil inventories likely to be the most pronounced in the first half of next year.

The US Energy Information Agency (EIA) expects Brent crude prices to be on average $3 cheaper next year at $61/bbl, and WTI prices to be on average $5.5/bbl below Brent crude prices:

When

What

Why is it important

Monday 16 Dec

OPEC Monthly oil market report

Insight into the oil output changes from OPEC members

Monday 16 Dec

US manufacturing PMI

Still in expansion territory, last at 52.4

Monday 16 Dec

US housing market index

Last at 70

Tuesday 17 Dec

EU trade balance

Trade data with China of particular interest

Tuesday 17 Dec

US housing starts

Health of the US construction industry

Tuesday 17 Dec

US industrial production

Taking the pulse of US industry, last up 0.8%

Tuesday 17 Dec

US capacity utilization

Look out for oil industry utilization rates

Tuesday 17 Dec

API weekly crude oil stocks

For the week ending Dec 13

Wednesday 18 Dec

ECB’s Lagarde speech

Ms Lagarde set out her rate policy on Thursday but any new comments about the health of the Eurozone could move markets

Wednesday 18 Dec

Germany IFO business climate

Expectations for German business

Wednesday 18 Dec

EIA crude oil stocks

Last at 0.822m

Wednesday 18 Dec

CFTC commitment of oil traders

CFTC publishes the report early this week. It is normally released on Fridays.

Thursday 19 Dec

US initial jobless claims

Insight into the state of the US job market

Thursday 19 Dec

US Philadelphia Fed manufacturing survey

Indicator of manufacturing sector trends

Friday 20 Dec

China interest rate decision

Rates currently at 4.15%

Pollution rule expected to affect US refinery runs

From the start of next year, new rules brought in by the International Maritime Organization will restrict the amount of sulphur in marine fuel oil in ships and tankers from 3.5% to 0.5%. Some ships will make smaller adjustments to avoid paying for the new type of fuel, but only about 30% of the ships will be able to do that while the rest of the vessels at sea will have little option but to switch fuels.

Even with shippers attempting to avoid compliance for as long as possible, global refineries will start to increase their refinery runs to upgrade as much of their high-sulphur heavy fuel into low-sulphur distillate fuel compliant with the new requirements as possible. The knock-on effect on crude oil prices will come from higher refinery utilization rates, which typically tend to dampen oil prices. According to the US EIA, US refineries are expected to increase their refinery runs by 3% by next year to a record level of 17.5 million b/d. This would boost refinery utilization rates to an average of 93% in 2020.

Original from: www.forex.com

No Comments on “OIL MARKET WEEK AHEAD: New Shipping Fuel Regulations to Hit Oil Markets from January 1”