Home / Forex news / OIL MARKET WEEK AHEAD: OPEC vs electric cars, who will have the bigger leverage in the long run?

The discussions in Vienna could become quite interesting this week, particularly on the second day when Russia joins Saudi Arabia and other OPEC producers in discussions about production cuts. Saudi Arabia has signaled it wants OPEC+ countries to adhere more closely to the production cuts they agreed a year ago (and subsequently extended six months ago), but it will have little leverage over Russia, a serial offender when it comes to exceeding its quotas.

Russia is not the only country that has been dragging its feet in meeting lower production targets; at least three other member states have simmering political problems at home and will be less than keen to see state incomes dwindle. However, for Saudi Arabia, propping up the oil price is becoming more urgent as state-owned producer Aramco is about to IPO. The publication of Aramco’s final IPO price on 5 December, the day OPEC goes into session, will add extra pressure to the output discussions.

Beware electric car sales

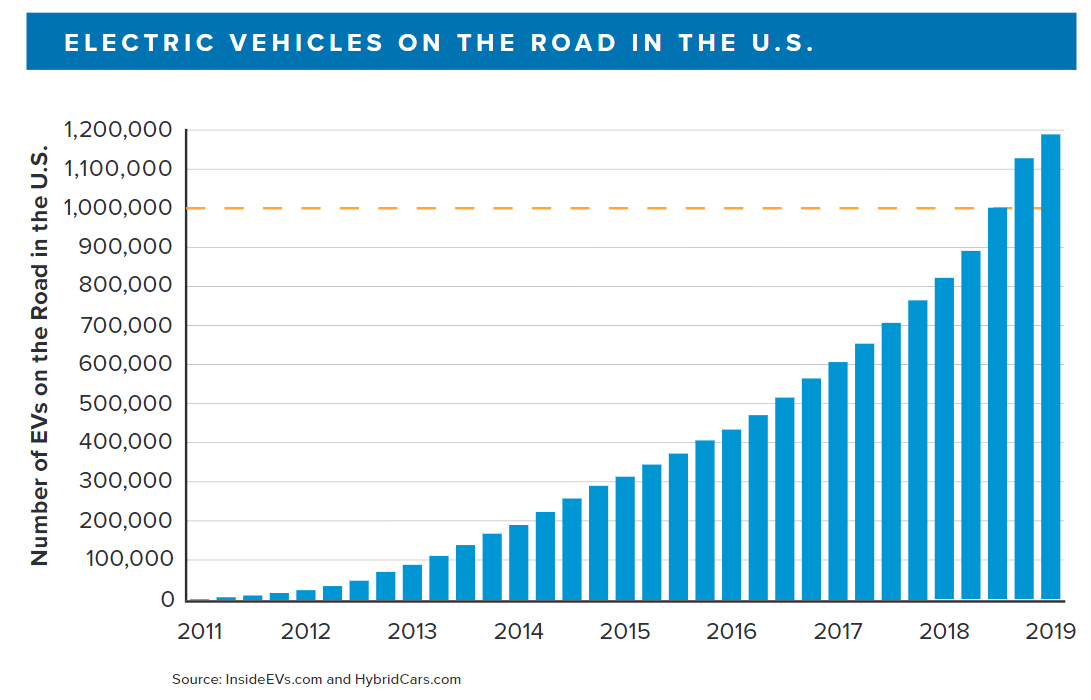

In a world beyond OPEC – and there is such a thing for oil – further forward contracts are likely to be more influenced by electric car sales than just the issue of how much oil is pumped out of the ground.

In the US, transportation now makes up 73% of the total petroleum consumption. Cars, trucks and buses account for 60% of the total demand, distillate fuel oil 24% while jet fuel makes up a modest 13%.

Electric car sales have seen explosive growth this year, expanding by 125% year-to-date. Car makers are gearing up for bumper sales in 2020 with BMW, Audi, Ford and VW all putting out new models. Most of the models are far from geeky – bar the small Honda e – they have managed to shake off their somewhat tree-hugging image of the early days and are ranging from sports cars to SUVs. The pendulum of demand is clearly swinging in the direction of electric as demonstrated by Daimler who decided to cut 10,000 jobs worldwide in order to free up money for the costly development of electric vehicles. In the UK currently one in every ten cars sold is an electric or hybrid car, which means there is a vast scope for growth against traditionally petrol fueled cars.

Misleading rig count

Though the weekly Baker Hughes US rig count makes for catchy headlines and a quick trade signal, but the number of rigs in operation alone is misleading as a tool for analyzing US supply. Last week’s number is a case in point: The number of active US rigs fell by 3 to 671 in the week ending 22 Nov marking the fifth consecutive decline. More importantly the number of active rigs in the US has dropped by 276 over the last twelve months. And yet, US output has risen from 11.7m barrels per day to an all-time high of 12.8m bpd since the beginning of this year.

The next set of numbers are due out on Friday, as is Baker Hughes’ international rig count which is released once a month, but both of these figures should be scrutinized a bit more closely to make for a meaningful signal.

When

What

Why is it important

Monday 1 Dec

CFTC Commitment of Traders report

Delayed from last week because of Thanksgiving

Tuesday 2 Dec

API weekly crude oil stocks

Last at 3.639m

Tuesday 2 Dec

US total vehicle sales

Key demand data

Wednesday 3 Dec

US crude oil inventories

Last 1.572m

Wednesday 3 Dec

EIA weekly refinery utilization rates

Last -0.2%

Thursday 5 Nov

German factory orders

A barometer of industrial demand

Thursday 5 Nov

Eurozone Q3 GDP

Indicator of health of Eurozone demand

Thursday 5 Nov

OPEC meeting starts in Vienna

Saudi Arabia expected to push for higher compliance from other members

Thursday 5 Nov

Saudi Aramco will set final IPO price

Start of trading expected mid-December

Thursday 5 Nov

US jobless claims

Taking the pulse of US economy

Thursday 5 Nov

US trade balance, October

Useful for analyzing the impact of US-China trade balance

Friday 6 Nov

Non-OPEC ministers join OPEC

Russia and other OPEC+ countries will join official OPEC production discussions

Friday 6 Nov

Baker Hughes weekly US rig count

Number of rigs declined in the last five weeks

Friday 6 Nov

Baker Hughes monthly international rig count

1,130 in October, down 1 m/m

Original from: www.forex.com

No Comments on “OIL MARKET WEEK AHEAD: OPEC vs electric cars, who will have the bigger leverage in the long run?”