Home / Forex news / OIL WEEK AHEAD: Will Russia, or won’t it?

A week has already passed since the OPEC technical committee recommended that the cartel and Russia deepen the production cuts to balance out the demand reduction that will come from the coronavirus. And yet, Russia has yet to make a decision, stalling for time to see if the news flow from China will disprove OPEC’s worst-case scenario expectations now that the spread of the virus seems to have slowed down a bit (yesterday’s big revision notwithstanding).

After OPEC made its recommendation, Russia’s Energy Minister met with domestic oil producers, but they managed to avoid making a key decision until next week when the larger part of China’s industry – that has been shuttered during the coronavirus outbreak – is expected to start operating again close to normal capacity. The week ahead should bring a final response from Russia, even be it one that OPEC may not want to hear. Even if that happens, OPEC may still go ahead and cut its production, reaching a decision at the latest at its next scheduled meeting in Vienna at the beginning of March.

Car production contagion

The aftermath of the coronavirus is not dissimilar to cleaning the house after a raucous party, with a new damaged item found every day. In no industry is this more the case than with car producers where the disruption in the supply of smaller items and spare parts has or may yet force producers outside of China to briefly stop assembling cars while they look for alternative supplies. South Korea’s Hyundai has been one of the worst hit producers outside of China, but by next week it is likely to resume output, albeit below previous production levels. European car production is also not out of the woods yet – so far Fiat Chrysler has warned that one or two of its European plants may find themselves having to stop production for a time as component supplies dry up. So far production in North America has not been faced with serious problems with parts supplies even though most cars contain some components that are produced in China.

Here is an overview of how car makers have been affected:

US market closure Monday shifts the week by a day

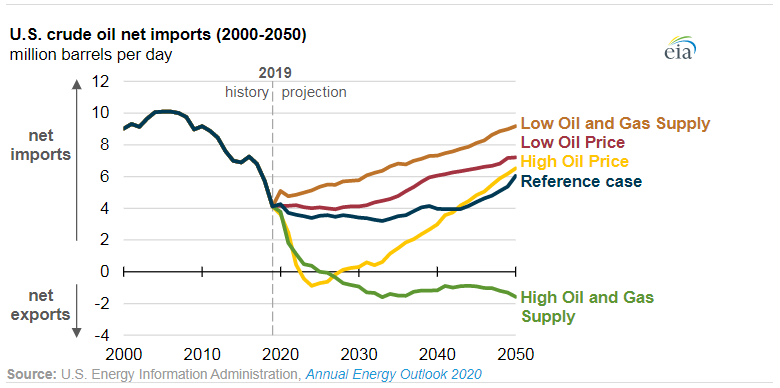

The US Presidents Day closure on Monday will shift back the release of oil-market related data like API weekly crude stocks and EIA’s stock data by one day. Last week the EIA reported an increase in crude oil stocks of 7.459m, in itself not hugely worrying in terms of demand given that this is within the band seen over the last few years. However seasonally, demand tended to be higher than this in January, and the latest increase reflected the unseasonably mild winter. It is also evidence of the continuing rise in the US oil production, unmatched by domestic demand growth, which is predicted to result in the US solidifying its position as a net exporter of crude until 2050, according to the EIA.

When

What

Why is it important

Monday 17 Feb

US Presidents Day

US markets closed

Tuesday 18 Feb 10.00

Germany ZEW survey

Institutional investors sentiment on German economy

Tuesday 18 Feb

ACEA Europe new car registrations

Registrations rose 21.7% in December

Wednesday 19 Feb 13.30

US Jan housing starts

Indicates the strength of the retail market

Wednesday 19 Feb 21.30

API US weekly crude oil stocks

Last 6m

Thursday 20 Feb 01.30

China PBOC interest rate decision

Gauge of direction of Chinese economy, last at 4.5%

Thursday 20 Feb 13.30

US initial jobless claims

Relates to the strength of the retail market

Thursday 20 Feb 16.00

EIA Crude oil stocks

Last up 7.459m

Friday 21 Feb 08.30

Germany Feb manufacturing PMI

Last in contraction territory at 45.3

Friday 21 Feb 14.45

US Feb manufacturing PMI

Last in 51.9 indicating expansion

Friday 21 Feb 18.00

Baker Hughes oil rig count

Friday 21 Feb 20.30

CFTC oil net positions

Money managers’ oil positions

Original from: www.forex.com

No Comments on “OIL WEEK AHEAD: Will Russia, or won’t it?”