Home / Forex news / Target at 112.07 for USD/JPY

The United States dollar versus the Japanese yen currency pair seems to have eyed the 112.07 level. Are the bears interested in turning the market around from here?

Long-term perspective

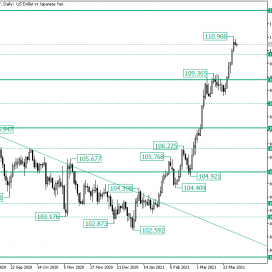

The 102.59 low, a seemingly new lower low not different from the previous ones, was to be the one that would radically shift the market’s direction, even if the majority of participants were not expecting such unfolding simply because the descending trend appeared so rooted.

Yet, the price climbed until the 110.06 high after two corrections — from 105.76 to 104.40, and from 106.22 to 104.92, respectively — and a consolidation phase — which flattened under the 109.08 firm level.

So, as every thrust was followed by a pause, one may expect the history to repeat itself. As a consequence, from the 110.96 high, the price could print a throwback to the 110.10 intermediary level.

If the level still favors the bulls, then 110.10 may be the starting point for a new rally that aims for 112.07. Even if the price slips under 110.10, as long as it does not come too close to 109.08, the bulls may be very interested in buying the dips.

On the other hand, if a fall indeed extends to 109.08, the upward movement can get delayed, but the tone would remain positive. Only if 109.08 cedes, then 108.05 gets exposed, which opens the door to the 107.00 psychological level.

Short-term perspective

After climbing to the 109.27 level, the price entered into a consolidative phase. The bulls made the first attempt to continue their whereabouts from the 108.35 low, but the same 109.27 resistance turned them around.

Nevertheless, the second endeavor — from 108.40 — succeed in penetrating the 109.27 ceiling and ended in a rise that extended until the 110.99 intermediary level.

The price may consolidate between 110.99 as resistance and 110.21 as support. Given the bullish pressure, the resistance area is the one expected to give way. This would allow the bulls to check 111.57 and conquer 112.13 as well — the latter is not highlighted on the chart.

On the other hand, if 110.21 fails, 109.66 is the first cushion to come to the bulls’ aid, with 109.27 acting as the second.

Levels to keep an eye on:

D1: 110.10 112.07 109.08 108.05 107.00

H4: 110.99 110.21 111.57 112.13 109.66 109.27

If you have any questions, comments, or opinions regarding the US Dollar, feel free to post them using the commentary form below.

Original from: www.earnforex.com

No Comments on “Target at 112.07 for USD/JPY”