Home / Forex news / USD/CAD probes resistance ahead of US retail sales

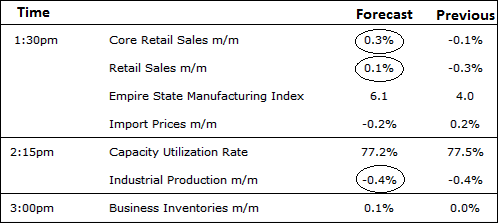

Today will see the release of several macroeconomic pointers from the US, starting from 13:30 GMT. Among them, we will have the latest monthly retail sales and industrial production data. The US dollar will therefore be in focus.

Here is what’s coming up and what is expected (important ones circled):

Among the dollar crosses, the USD/CAD will be the one to watch. Recently, the Canadian dollar has been trending lower after the Bank of Canada, at the end of last month, raised expectations it would cut interest rates as it expressed greater concern about global trade uncertainty.

Two weeks later and the Canadian dollar is still struggling, even if it has come off its weekly lows a little bit, causing the USD/CAD to ease. However, given the BOC’s U-turn on interest rates, the USD/CAD could rise further over time as the CAD weakens.

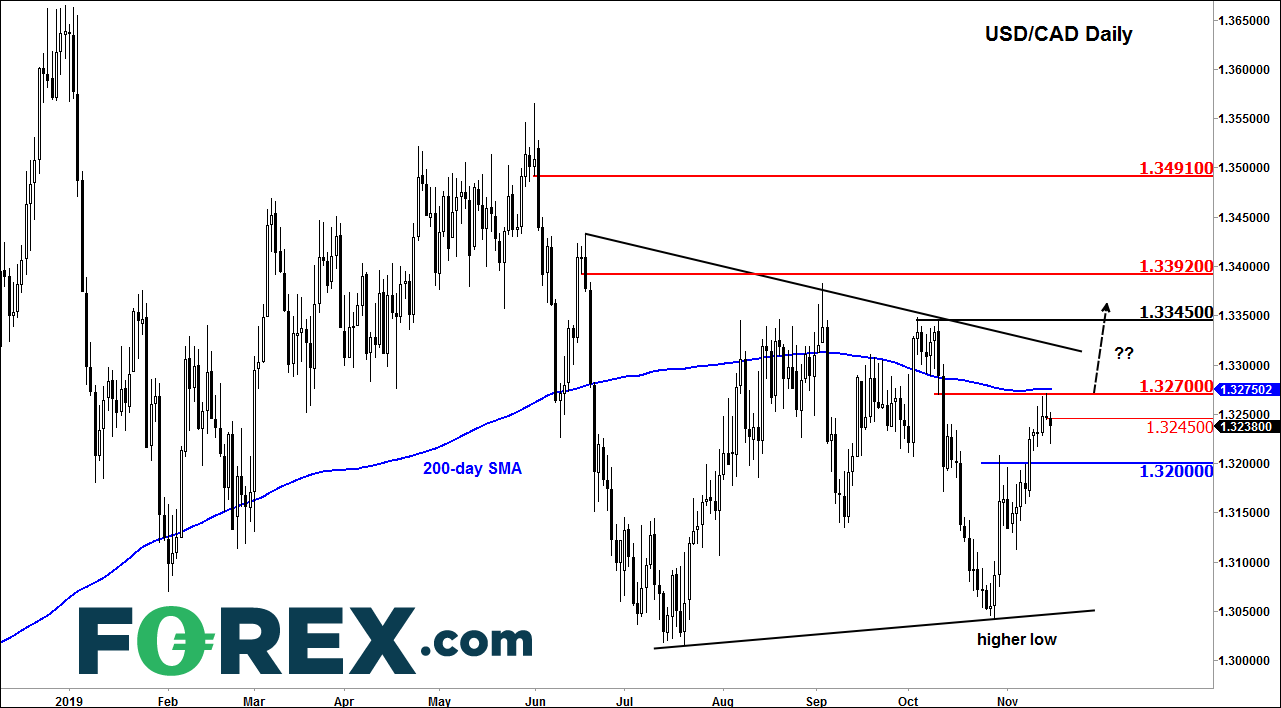

Source: eSignal and FOREX.com

Whether or not the USD/CAD will push higher today will depend to a great extent on the outcome of today’s US macro pointers:

Technically, the path of least resistance looks to be to the upside, in what still is an overall range-bound market. The recent low near 1.3050 was higher than the one made in the summer. Price has therefore created its first higher low, but still needs a higher high to confirm the bullish reversal. The most recent high comes in at 1.3345. A decisive break above this level in the coming trading days could be what the would-be bullish traders are looking for.

Original from: www.forex.com

No Comments on “USD/CAD probes resistance ahead of US retail sales”